U.S. Cattle on Feed Update – Apr ’22

Executive Summary

U.S. cattle on feed figures provided by the USDA were recently updated with values spanning through the end of Mar ’22. Highlights from the updated report include:

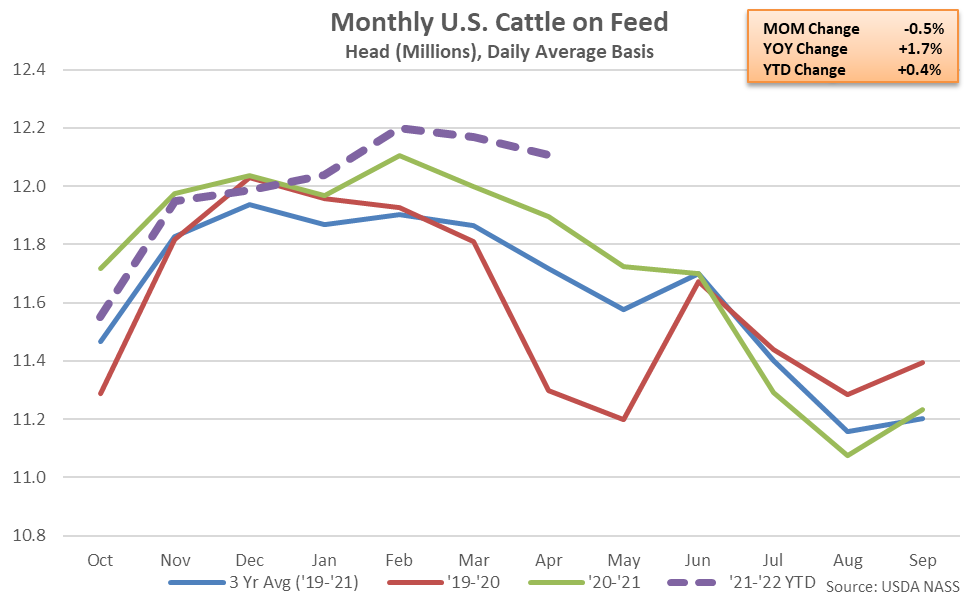

- U.S. cattle and calves on feed for the slaughter market as of Apr 1st finished 1.7% above previous year figures, remaining at a record high seasonal level for the third consecutive month. The YOY increase in the cattle on feed supply was larger than average analyst expectations of a 0.4% increase.

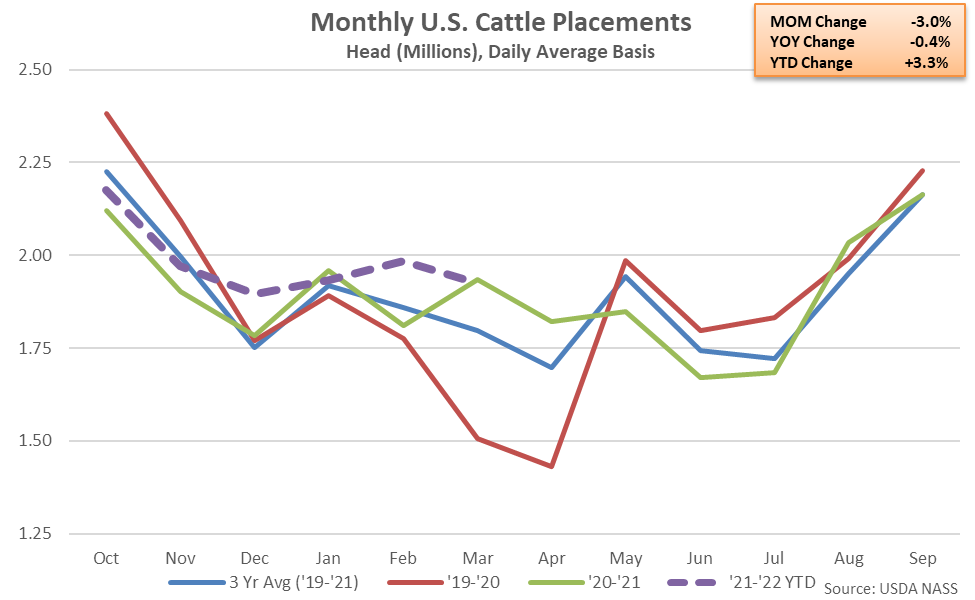

- Placements in feedlots declined 0.4% on a YOY basis throughout Mar ’22, finishing below previous year levels for just the second time in the past six months. The YOY decline in placements was significantly smaller than average analyst expectations of a 7.7% decline, however.

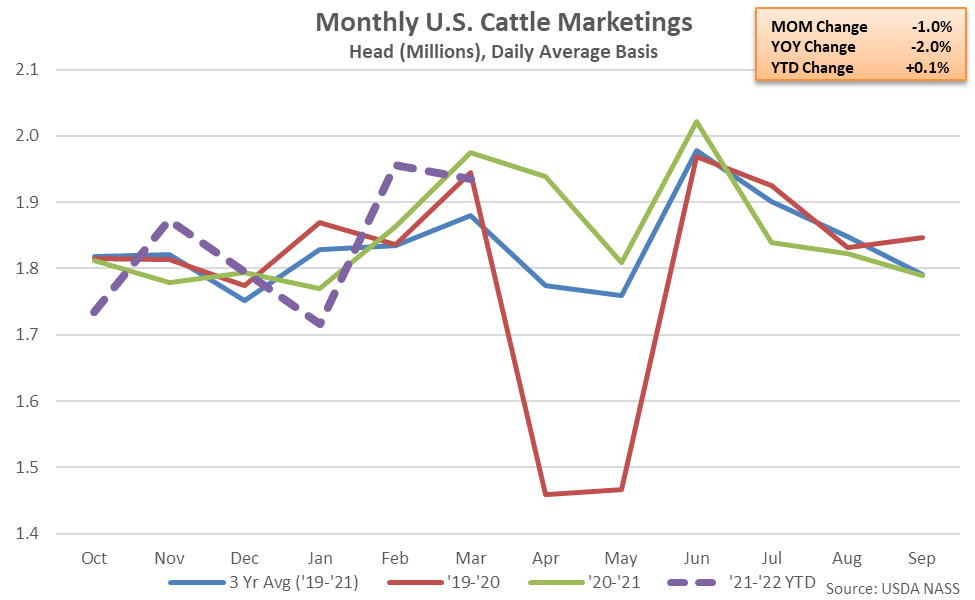

- Marketings of fed cattle declined 1.9% on a YOY basis throughout Mar ’22, reaching a three year low seasonal level. The YOY decline in marketings was consistent with average analyst expectations.

Additional Report Details

According to the USDA, Apr 1st cattle and calves on feed for the slaughter market in the U.S. for feedlots with capacity of a thousand head or more declined seasonally to a three month low level but remained 1.7% above previous year levels. The cattle on feed supply remained at a record high seasonal level for the third consecutive month. The YOY increase in the cattle on feed supply was the fourth experienced in a row and the largest experienced throughout the past 11 months. The 1.7% YOY increase in the cattle on feed supply was larger than average analyst expectations of a 0.4% YOY increase.

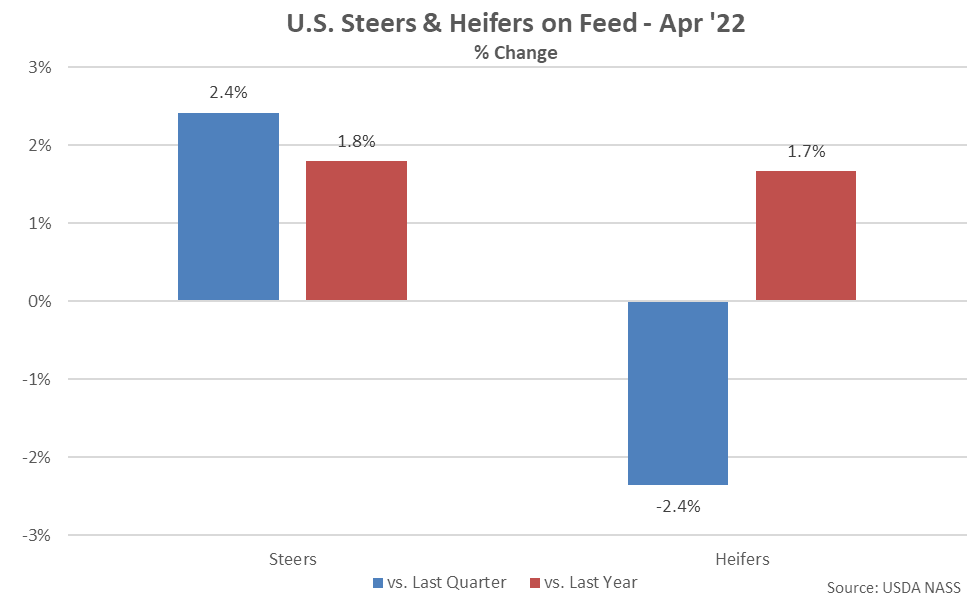

The Apr ’22 cattle on feed inventory included 7.54 million steers and steer calves, up 1.8% from 2021 levels, and 4.57 million heifers and heifer calves, up 1.7% from the previous year.

Mar ’22 placements in feedlots finished 0.4% below previous year levels, declining on a YOY basis for just the second time in the past six months. The 0.4% YOY decline in placements was significantly smaller than average analyst expectations of a 7.7% decline, however. YOY declines in placements were led by those weighing 600 pounds or less (-7.4%), followed by placements weighing 800 pounds or more (-0.4%). Placements finished above previous year levels in the 600-699 pounds (+1.5%) and 700-799 pounds (+3.9%) weight groupings.

’20-’21 annual placements in feedlots rebounded 0.2% from the four year low level experienced throughout the previous production season. ’21-’22 YTD placements have increased by an additional 3.3% on a YOY basis throughout the first half of the production season, despite the most recent decline, and are on pace to reach a four year high level.

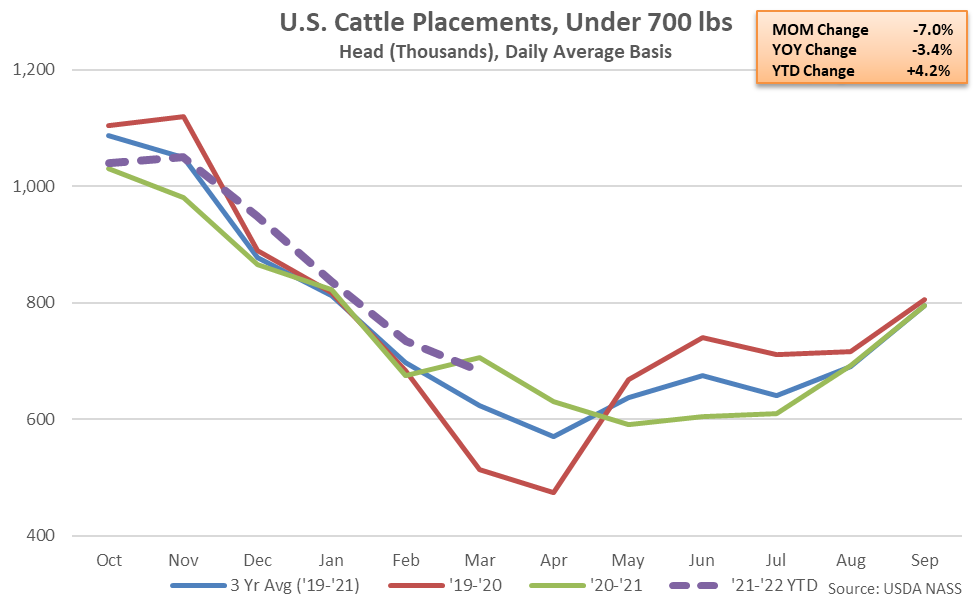

Cattle placements weighing under 700 pounds declined 3.4% on a YOY basis throughout Mar ’22 but remained at the second highest seasonal level experienced throughout the past eight years. The YOY decline in cattle placements weighing under 700 pounds was the first experienced throughout the past six months.

Cattle placements weighing under 700 pounds declined by 2.6% on a YOY basis throughout the ’20-’21 production season, reaching a four year low level. ’21-’22 YTD placements weighing under 700 pounds have rebounded by 4.2% on a YOY basis throughout the first half of the production season, however, despite the most recent decline.

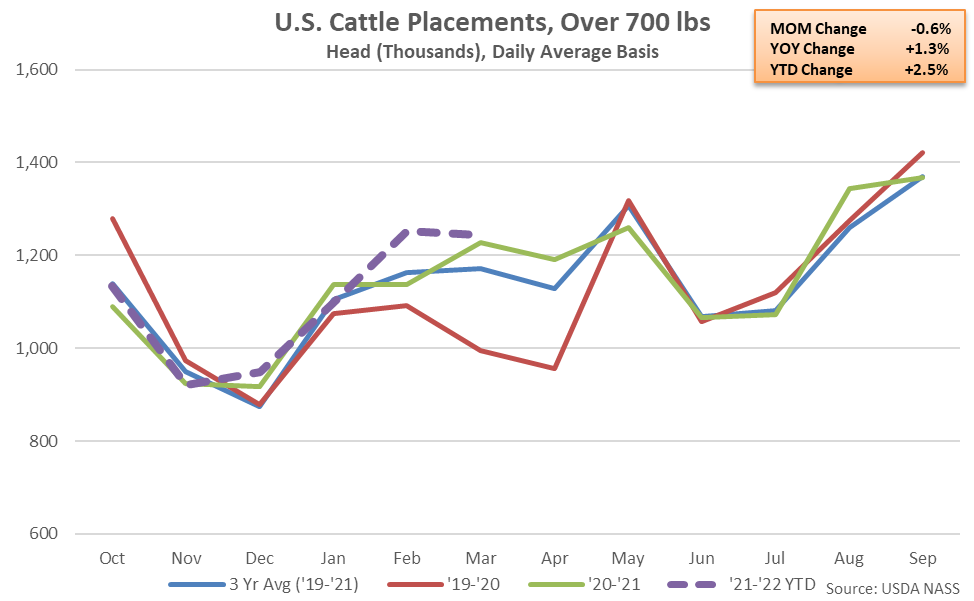

Cattle placements weighing 700 pounds or more increased 1.3% on a YOY basis throughout Mar ’22, remaining at a three year high seasonal level for the second consecutive month. The YOY increase in cattle placements weighing 700 pounds or more was the third experienced throughout the past four months.

Cattle placements weighing 700 pounds or more increased 2.2% on a YOY basis throughout the ’20-’21 production season, reaching a four year high level. ’21-’22 YTD placements weighing 700 pounds or more have increased by an additional 2.5% on a YOY basis throughout the first half of the production season.

Marketings of fed cattle declined 2.0% on a YOY basis throughout Mar ’22, reaching a three year low seasonal level. The 2.0% YOY decline in marketings was consistent with average analyst expectations of a 1.9% decline.

’20-’21 annual marketings of fed cattle increased 3.1% on a YOY basis, reaching a 13 year high level. ’21-’22 YTD marketings have increased by an additional 0.1% on a YOY basis throughout the first half of the production season, despite the most recent decline.