Grain & Oilseeds WASDE Update – Jan ’22

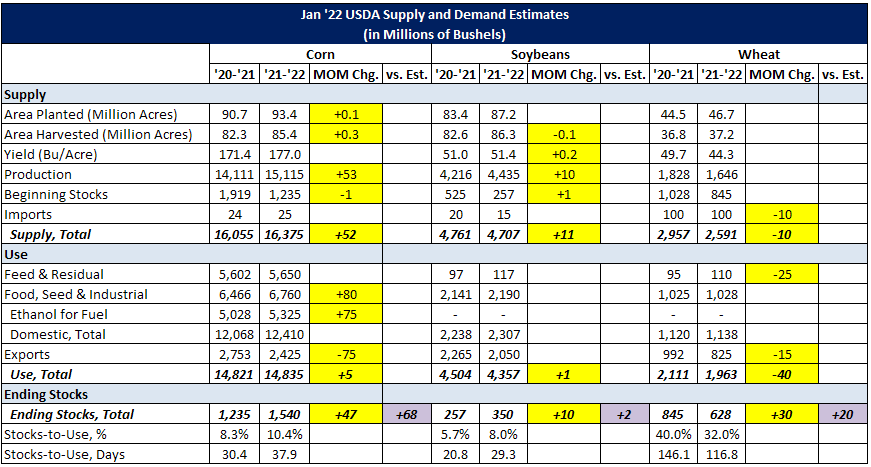

Corn – U.S. and Global Ending Stocks Slightly Mixed vs. Private Estimates

- ’21-’22 U.S. ending stocks of 1.54 billion bushels above expectations

- ’21-’22 global ending stocks of 303.1 million MT slightly below expectations

The ’21-’22 U.S. corn supply projection was raised slightly from the previous month, largely on an increase in projected harvested acres. The ’21-’22 U.S. corn demand projection was largely unchanged from the previous month as an increase in projected ethanol demand offset lower projected exports. ’21-’22 projected U.S. corn ending stocks of 1.54 billion bushels, or 37.9 days of use, finished 3.1% above the previous month and 4.6% above expectations.

The ’21-’22 global corn ending stock projection finished 0.8% below the previous month and 0.2% below expectations, largely on a decline in projected Brazilian production, which more than offset the increase in projected domestic corn stocks. Reductions in projected Brazilian corn production reflected reduced yield expectations for first-crop corn in southern Brazil.

Soybeans – U.S. and Global Ending Stocks Mixed vs. Private Estimates

- ’21-’22 U.S. ending stocks of 350 million bushels slightly above expectations

- ’21-’22 global ending stocks of 95.2 million MT below expectations

The ’21-’22 U.S. soybean supply projection was raised slightly from the previous month as an increase in projected yields more than offset lower projected harvested acres. The ’21-’22 U.S. soybean demand projection was virtually unchanged from the previous month. ’21-’22 projected U.S. soybean ending stocks of 350 million bushels, or 29.3 days of use, finished 2.9% above the previous month and 0.6% above expectations.

The ’21-’22 global soybean ending stock projection finished 6.7% below the previous month and 4.5% below expectations, largely on reductions in projected Brazilian and Argentine production. Dry weather conditions were experienced throughout the month of December and early January in southern Brazil, while lower harvested acres and yields are expected throughout Argentina.

Soybean Complex – U.S. Oil & Meal Stocks Unchanged

The ’21-’22 U.S. soybean oil ending stock projection remained unchanged from the previous month as higher projected production offset higher projected export volumes. Globally, the ’21-’22 soybean oil ending stock projection was raised from the previous month, led by projected increases experienced throughout Brazil and Argentina.

The ’21-’22 U.S. soybean meal ending stock projection also remained unchanged from the previous month as lower projected production offset lower projected export volumes. Globally, the ’21-’22 global soybean meal ending stock projection was reduced from the previous month, largely on projected reductions in Brazilian and Argentine production.

Wheat – U.S. and Global Ending Stocks Above Private Estimates

- ’21-’22 U.S. ending stocks of 628 million bushels above expectations

- ’21-’22 global ending stocks of 280.0 million MT slightly above expectations

The ’21-’22 U.S. wheat supply projection was reduced slightly from the previous month on a reduction in projected imports while the U.S. wheat demand projection was also reduced from the previous month, on declines in feed & residual usage and exports. ’21-’22 projected U.S. wheat ending stocks of 628 million bushels, or 116.8 days of use, finished 5.0% above the previous month and 3.3% above expectations.

The ’21-’22 global wheat ending stock projection finished 0.6% above the previous month and 0.4% above expectations, largely on increases experienced throughout the U.S., Russia and Kazakhstan.

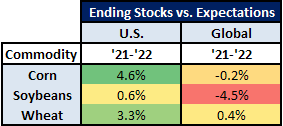

Ending Stocks vs. Expectations Summary

Overall, ’21-’22 projected domestic corn ending stocks finished most significantly above expectations, followed by domestic wheat ending stocks, domestic soybean ending stocks and global wheat ending stocks. Global soybean ending stocks finished most significantly below expectations, followed by global corn ending stocks.