Quarterly Canadian Milk Production Update – Sep ’19

Executive Summary

Canadian milk production figures provided by Statistics Canada were recently updated with values spanning through the end of the ’18-’19 production season. Highlights from the updated report include:

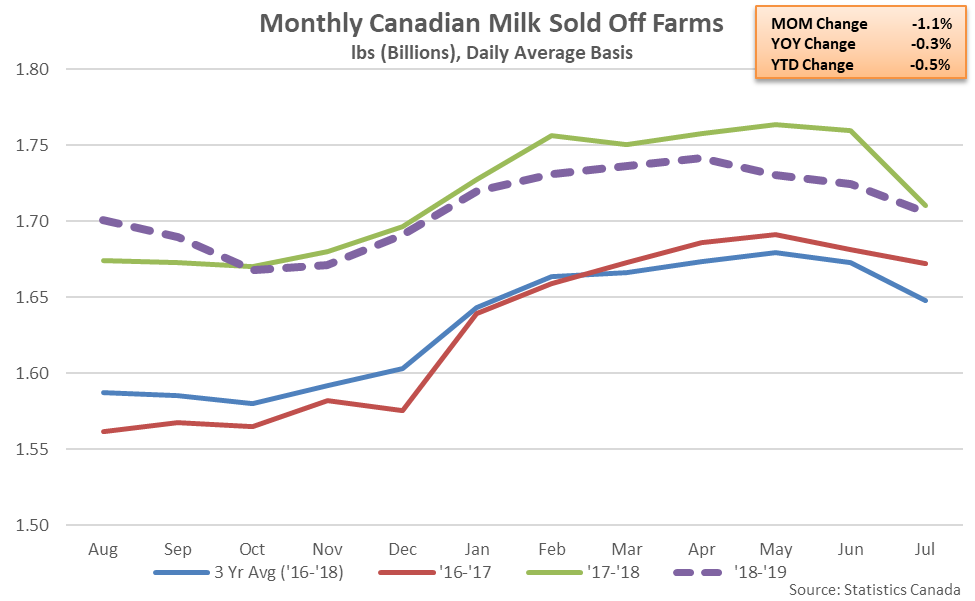

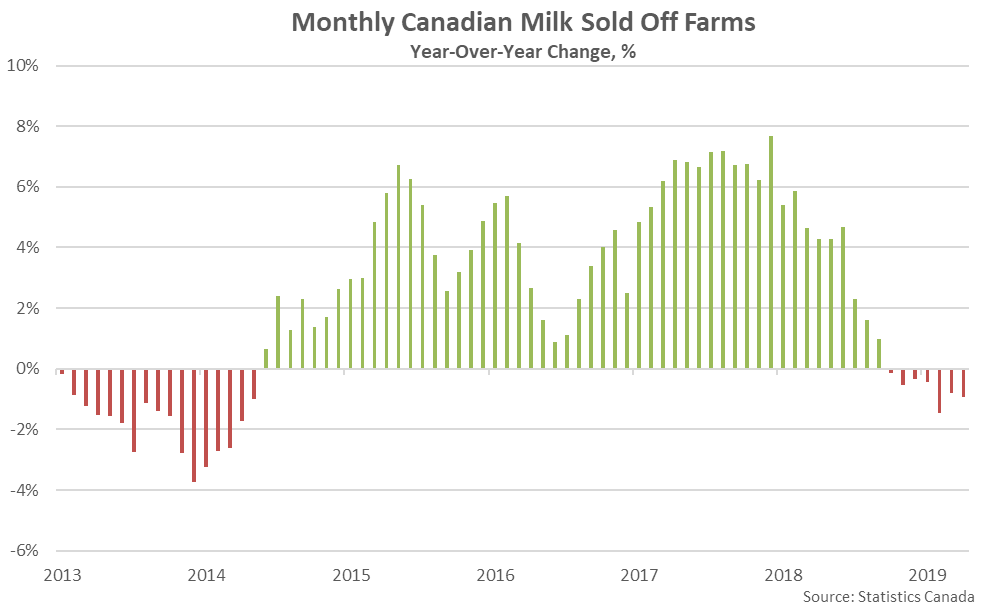

Milk produced within Canada supplies two markets – the fluid milk market, which includes milk used for direct consumption, creams and flavored milks, and the industrial milk market, which includes milk used to make dairy products including butter, cheese, milk powder, yogurt and ice cream. Over the past five years, the industrial milk market has accounted for just under two thirds of the total Canadian milk sold off farms. Throughout the ’18-’19 production season, Canadian milk sold for industrial purposes declined 0.6% YOY while milk sold for fluid purposes declined 0.4%.

Milk produced within Canada supplies two markets – the fluid milk market, which includes milk used for direct consumption, creams and flavored milks, and the industrial milk market, which includes milk used to make dairy products including butter, cheese, milk powder, yogurt and ice cream. Over the past five years, the industrial milk market has accounted for just under two thirds of the total Canadian milk sold off farms. Throughout the ’18-’19 production season, Canadian milk sold for industrial purposes declined 0.6% YOY while milk sold for fluid purposes declined 0.4%.

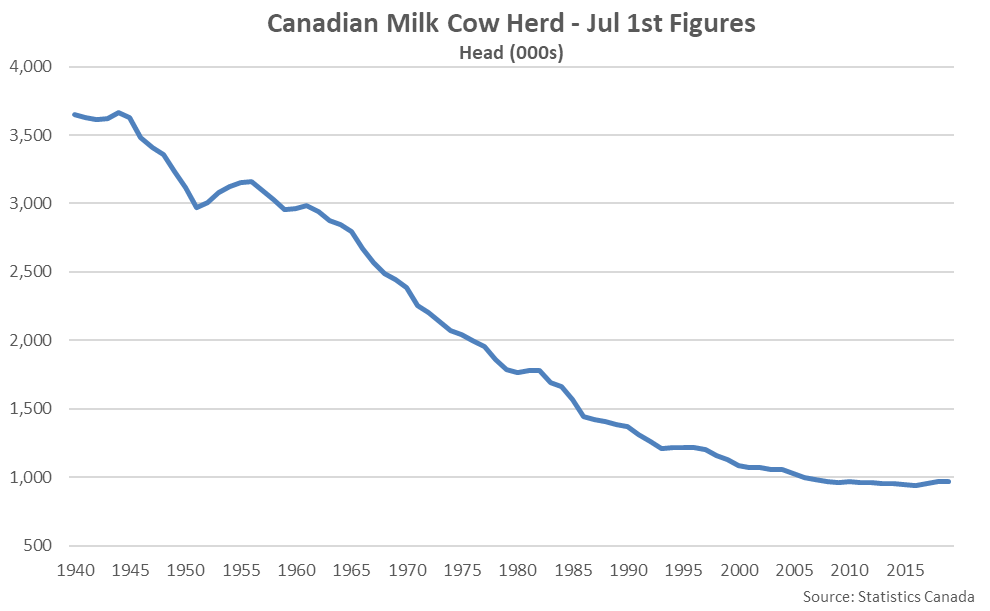

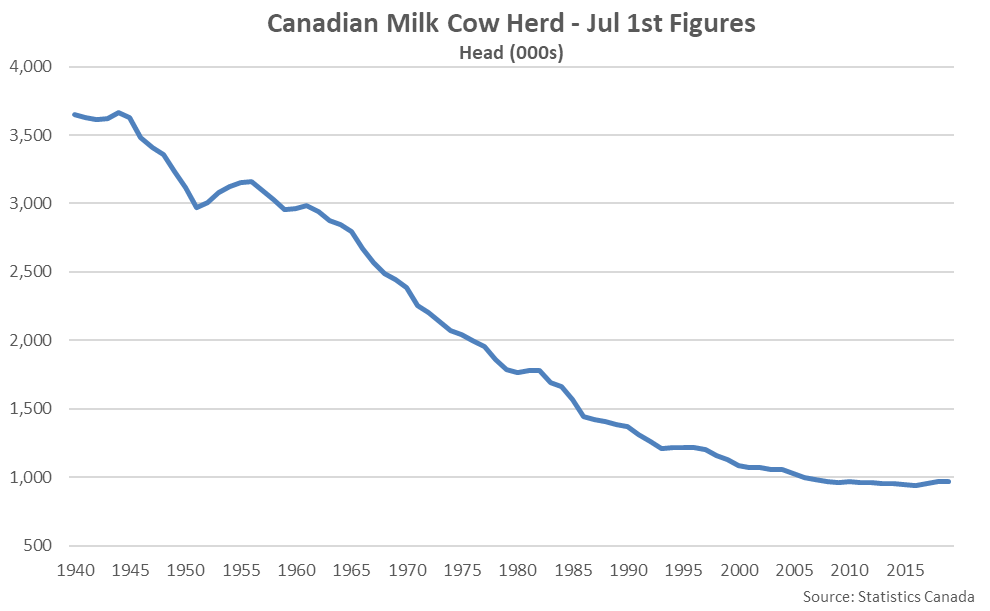

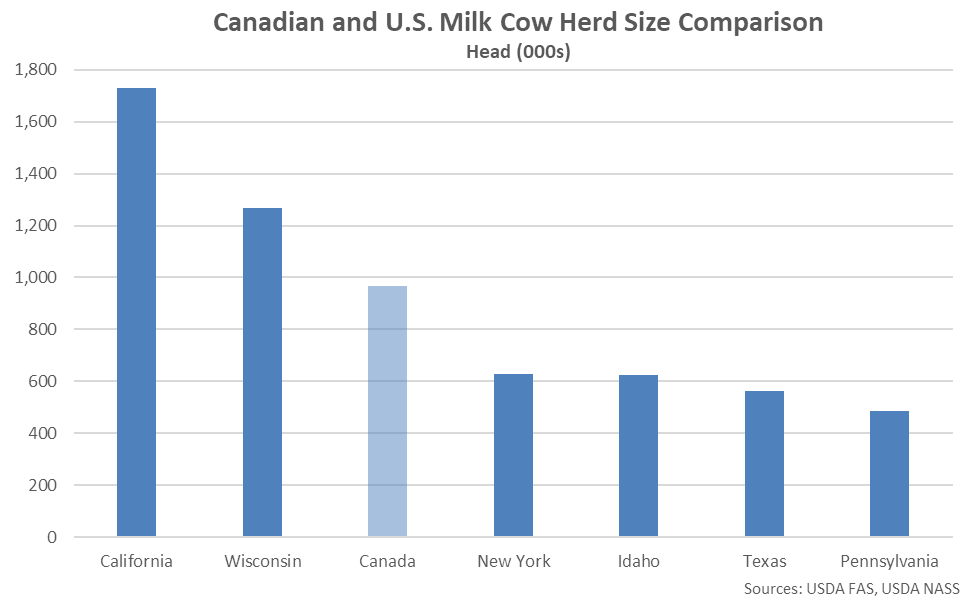

Canadian milk production has increased significantly over recent years despite milk cow figures remaining at or near the lowest figures on record. The Canadian milk cow herd has plateaued over the last several years following significant declines experienced since the beginning of the Canadian dairy supply management system. Statistics Canada shows the Canadian milk cow herd declining slightly on a YOY basis as of Jul 1st, 2019, but remaining 1.3% above three year average figures.

Canadian milk production has increased significantly over recent years despite milk cow figures remaining at or near the lowest figures on record. The Canadian milk cow herd has plateaued over the last several years following significant declines experienced since the beginning of the Canadian dairy supply management system. Statistics Canada shows the Canadian milk cow herd declining slightly on a YOY basis as of Jul 1st, 2019, but remaining 1.3% above three year average figures.

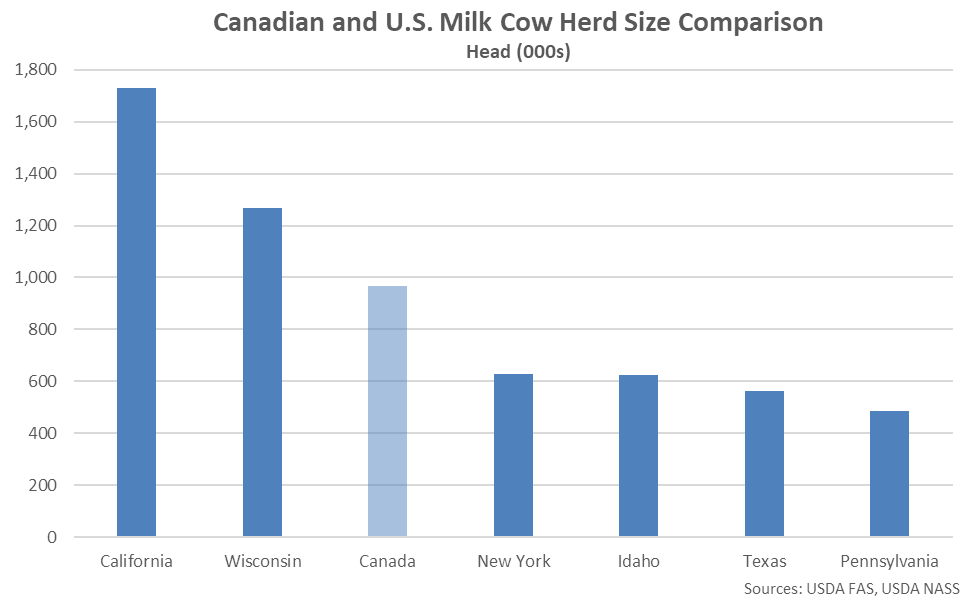

Overall, the Canadian milk cow herd is equivalent to just over 10% of the total U.S. milk cow herd. When compared on a state-by-state basis, the Canadian milk cow herd is equivalent to approximately 55% of the California milk cow herd and 75% of the Wisconsin milk cow herd.

Overall, the Canadian milk cow herd is equivalent to just over 10% of the total U.S. milk cow herd. When compared on a state-by-state basis, the Canadian milk cow herd is equivalent to approximately 55% of the California milk cow herd and 75% of the Wisconsin milk cow herd.

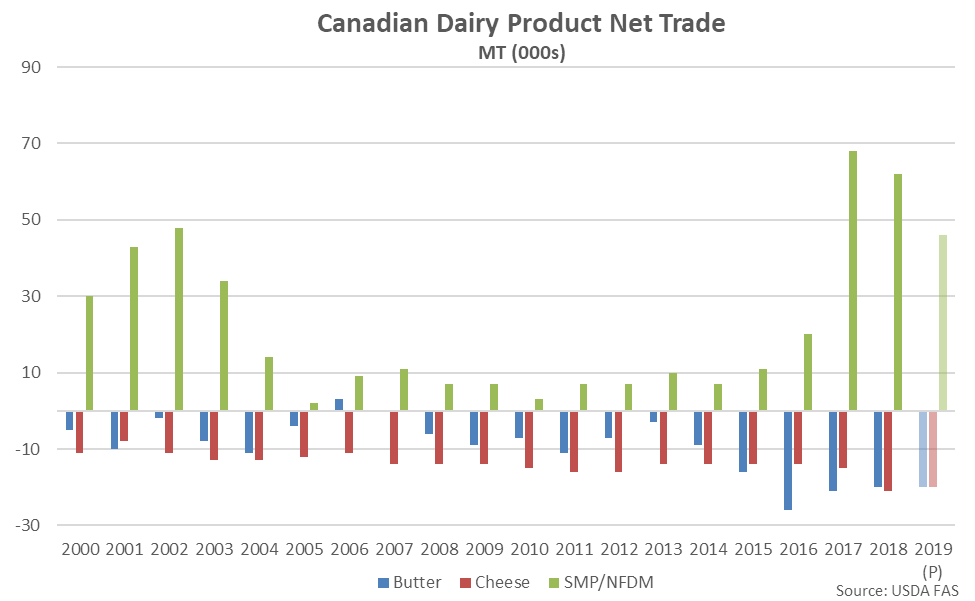

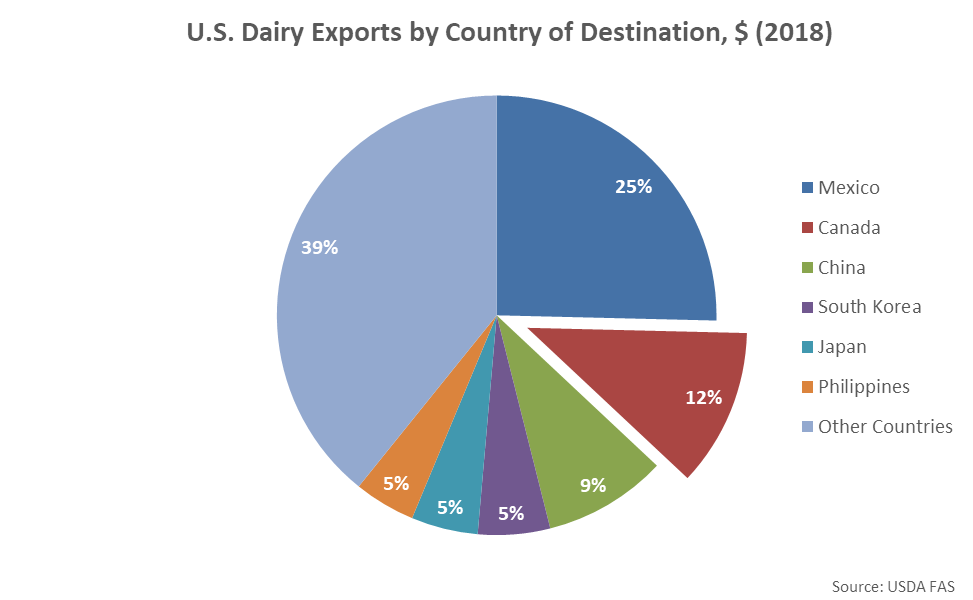

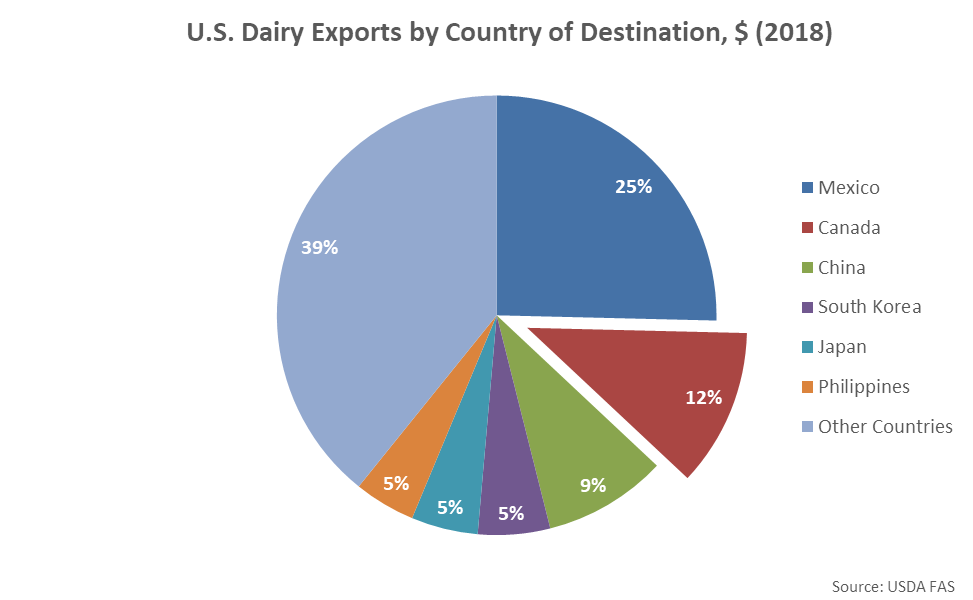

Because of the close proximity of the two countries, the U.S. has been the largest trade partner for both Canadian exports and imports of dairy products over the past several years. Canada has traditionally been a net importer of dairy products, despite heavy import tariffs, with the majority of import volumes originating from within the United States. Overall, Canada finished as the second largest importer of U.S. dairy products throughout 2018, trailing only Mexico.

Because of the close proximity of the two countries, the U.S. has been the largest trade partner for both Canadian exports and imports of dairy products over the past several years. Canada has traditionally been a net importer of dairy products, despite heavy import tariffs, with the majority of import volumes originating from within the United States. Overall, Canada finished as the second largest importer of U.S. dairy products throughout 2018, trailing only Mexico.

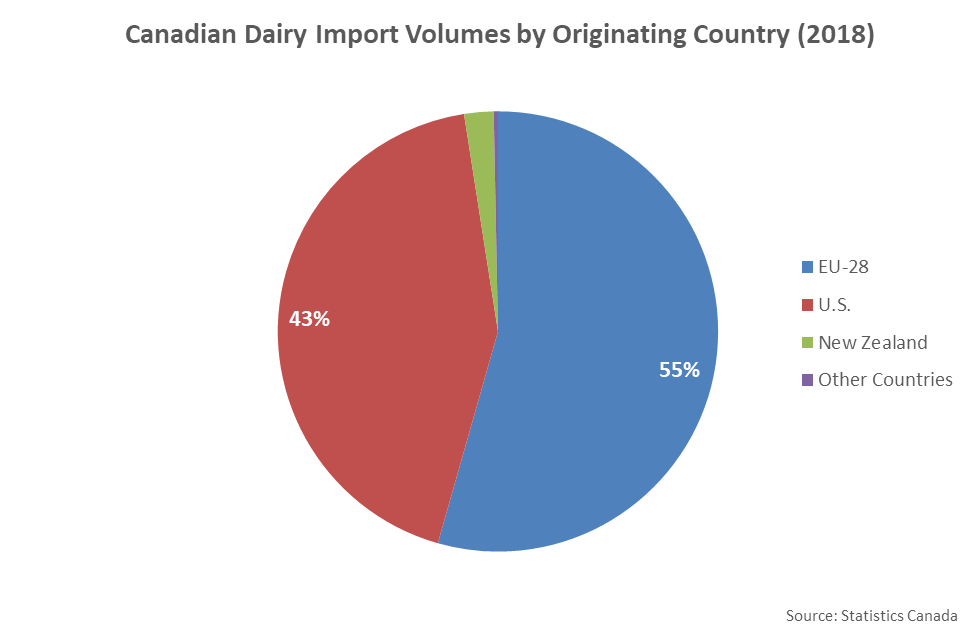

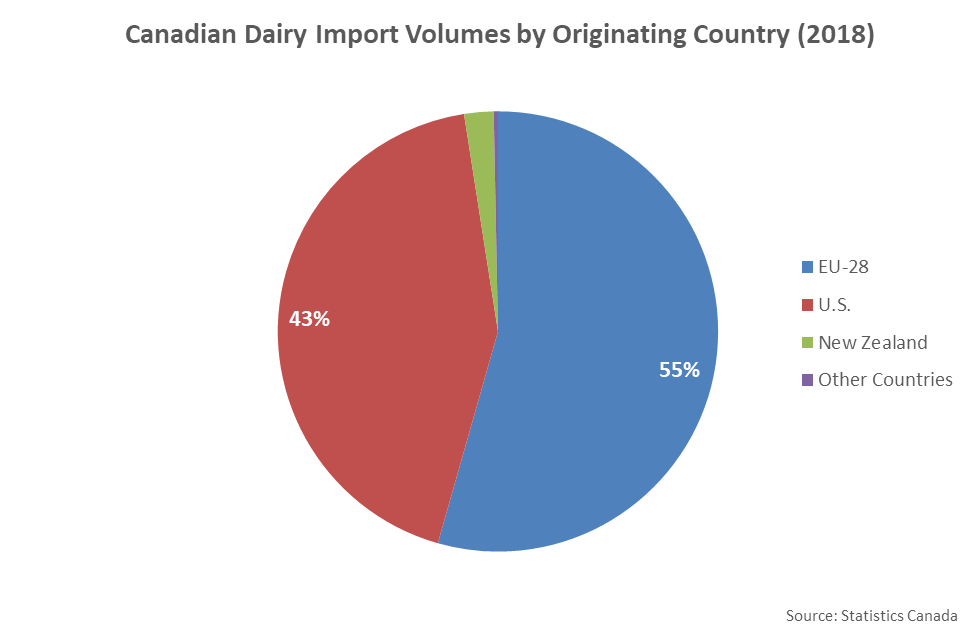

Throughout 2018, the EU-28 accounted for 55% of Canada’s dairy import volumes (up 14% from the previous year), while the U.S. had a market share of 43% (down 14% from the previous year). The EU-28 market share of Canadian dairy import volumes outpaced the U.S. market share of Canadian dairy import volumes for the first time on record throughout 2018.

Throughout 2018, the EU-28 accounted for 55% of Canada’s dairy import volumes (up 14% from the previous year), while the U.S. had a market share of 43% (down 14% from the previous year). The EU-28 market share of Canadian dairy import volumes outpaced the U.S. market share of Canadian dairy import volumes for the first time on record throughout 2018.

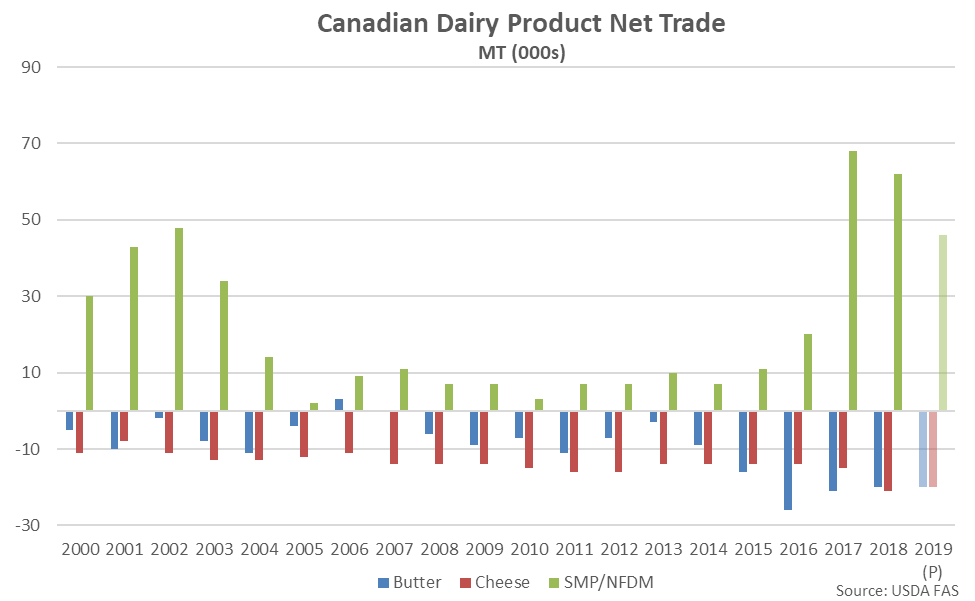

Canadian net dairy imports have traditionally been led by butter and cheese, while Canada has remained a net exporter of skim milk powder/nonfat dry milk. Canadian SMP/NFDM export volumes increased significantly throughout 2017, aided by the introduction of newly created class of milk. In Mar ’17, Canada created a Class 7 milk class to price products including protein concentrates, skim milk powder and whole milk powder. The newly created milk class is priced at the lower of skim milk powder or whole milk powder prices observed throughout major dairy exporting regions, effectively guaranteeing that Canadian product will always be competitive globally.

USDA expects Canadian SMP/NFDM export volumes will continue to remain near the 2017 record high levels, however the Canadian government recently agreed to eliminate the Class 7 milk class as part of the United States-Mexico-Canada Agreement (USMCA). Under the USMCA, Canadian skim milk powder, milk protein concentrate and infant formula will be priced at U.S. price levels instead of the lowest of prices experienced throughout the major dairy exporting regions. Under the USMCA, the Canadian Class 7 milk class must be eliminated six months after the agreement is signed into order. In addition to abolishing Canada’s Class 7 milk class, the United States-Mexico-Canada Agreement also provides the U.S. producers with access to approximately 3.6% of Canada’s dairy market under a tariff-free quota.

Canadian net dairy imports have traditionally been led by butter and cheese, while Canada has remained a net exporter of skim milk powder/nonfat dry milk. Canadian SMP/NFDM export volumes increased significantly throughout 2017, aided by the introduction of newly created class of milk. In Mar ’17, Canada created a Class 7 milk class to price products including protein concentrates, skim milk powder and whole milk powder. The newly created milk class is priced at the lower of skim milk powder or whole milk powder prices observed throughout major dairy exporting regions, effectively guaranteeing that Canadian product will always be competitive globally.

USDA expects Canadian SMP/NFDM export volumes will continue to remain near the 2017 record high levels, however the Canadian government recently agreed to eliminate the Class 7 milk class as part of the United States-Mexico-Canada Agreement (USMCA). Under the USMCA, Canadian skim milk powder, milk protein concentrate and infant formula will be priced at U.S. price levels instead of the lowest of prices experienced throughout the major dairy exporting regions. Under the USMCA, the Canadian Class 7 milk class must be eliminated six months after the agreement is signed into order. In addition to abolishing Canada’s Class 7 milk class, the United States-Mexico-Canada Agreement also provides the U.S. producers with access to approximately 3.6% of Canada’s dairy market under a tariff-free quota.

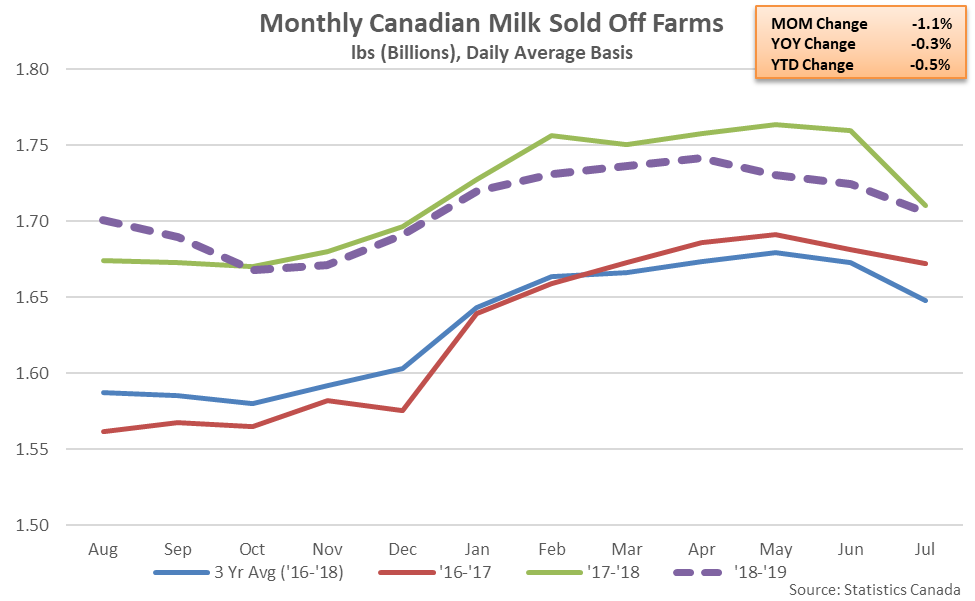

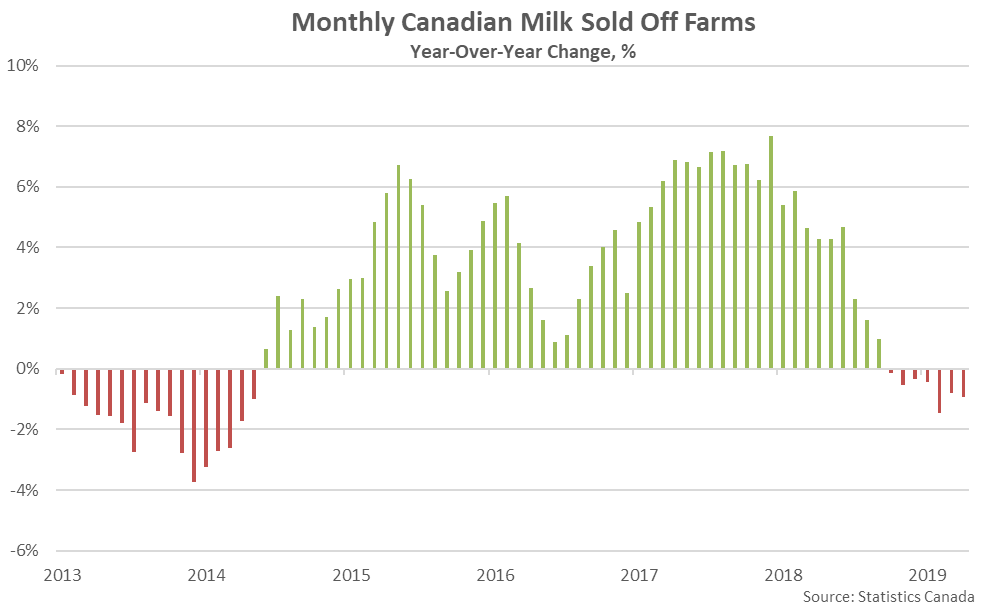

- Canadian milk sold off farms has slowed of late, declining on a YOY basis over ten consecutive months through Jul ’19. ’18-’19 annual Canadian milk sold off farms declined 0.5% YOY from the record high levels experienced throughout the previous production season but remained at the second highest annual level on record.

- The Canadian milk cow herd has plateaued over the last several years following significant declines experienced since the beginning of the Canadian dairy supply management system. Statistics Canada shows the Canadian milk cow herd declining slightly on a YOY basis as of Jul 1st, 2019, but remaining 1.3% above three year average figures.

- The Canadian milk cow herd and milk production volumes have expanded since the Mar ’17 creation of Class 7 milk, which has been used to price powder at the lowest of prices observed throughout major dairy exporting regions, effectively guaranteeing that Canadian product will always be competitive globally. Canadian powder export volumes have increased significantly since Class 7 milk has been put in place, however the Canadian government recently agreed to eliminate the Class 7 milk class as part of the United States-Mexico-Canada Agreement (USMCA). Under the USMCA, the Canadian Class 7 milk class must be eliminated six months after the agreement is signed into order.

Milk produced within Canada supplies two markets – the fluid milk market, which includes milk used for direct consumption, creams and flavored milks, and the industrial milk market, which includes milk used to make dairy products including butter, cheese, milk powder, yogurt and ice cream. Over the past five years, the industrial milk market has accounted for just under two thirds of the total Canadian milk sold off farms. Throughout the ’18-’19 production season, Canadian milk sold for industrial purposes declined 0.6% YOY while milk sold for fluid purposes declined 0.4%.

Milk produced within Canada supplies two markets – the fluid milk market, which includes milk used for direct consumption, creams and flavored milks, and the industrial milk market, which includes milk used to make dairy products including butter, cheese, milk powder, yogurt and ice cream. Over the past five years, the industrial milk market has accounted for just under two thirds of the total Canadian milk sold off farms. Throughout the ’18-’19 production season, Canadian milk sold for industrial purposes declined 0.6% YOY while milk sold for fluid purposes declined 0.4%.

Canadian milk production has increased significantly over recent years despite milk cow figures remaining at or near the lowest figures on record. The Canadian milk cow herd has plateaued over the last several years following significant declines experienced since the beginning of the Canadian dairy supply management system. Statistics Canada shows the Canadian milk cow herd declining slightly on a YOY basis as of Jul 1st, 2019, but remaining 1.3% above three year average figures.

Canadian milk production has increased significantly over recent years despite milk cow figures remaining at or near the lowest figures on record. The Canadian milk cow herd has plateaued over the last several years following significant declines experienced since the beginning of the Canadian dairy supply management system. Statistics Canada shows the Canadian milk cow herd declining slightly on a YOY basis as of Jul 1st, 2019, but remaining 1.3% above three year average figures.

Overall, the Canadian milk cow herd is equivalent to just over 10% of the total U.S. milk cow herd. When compared on a state-by-state basis, the Canadian milk cow herd is equivalent to approximately 55% of the California milk cow herd and 75% of the Wisconsin milk cow herd.

Overall, the Canadian milk cow herd is equivalent to just over 10% of the total U.S. milk cow herd. When compared on a state-by-state basis, the Canadian milk cow herd is equivalent to approximately 55% of the California milk cow herd and 75% of the Wisconsin milk cow herd.

Because of the close proximity of the two countries, the U.S. has been the largest trade partner for both Canadian exports and imports of dairy products over the past several years. Canada has traditionally been a net importer of dairy products, despite heavy import tariffs, with the majority of import volumes originating from within the United States. Overall, Canada finished as the second largest importer of U.S. dairy products throughout 2018, trailing only Mexico.

Because of the close proximity of the two countries, the U.S. has been the largest trade partner for both Canadian exports and imports of dairy products over the past several years. Canada has traditionally been a net importer of dairy products, despite heavy import tariffs, with the majority of import volumes originating from within the United States. Overall, Canada finished as the second largest importer of U.S. dairy products throughout 2018, trailing only Mexico.

Throughout 2018, the EU-28 accounted for 55% of Canada’s dairy import volumes (up 14% from the previous year), while the U.S. had a market share of 43% (down 14% from the previous year). The EU-28 market share of Canadian dairy import volumes outpaced the U.S. market share of Canadian dairy import volumes for the first time on record throughout 2018.

Throughout 2018, the EU-28 accounted for 55% of Canada’s dairy import volumes (up 14% from the previous year), while the U.S. had a market share of 43% (down 14% from the previous year). The EU-28 market share of Canadian dairy import volumes outpaced the U.S. market share of Canadian dairy import volumes for the first time on record throughout 2018.

Canadian net dairy imports have traditionally been led by butter and cheese, while Canada has remained a net exporter of skim milk powder/nonfat dry milk. Canadian SMP/NFDM export volumes increased significantly throughout 2017, aided by the introduction of newly created class of milk. In Mar ’17, Canada created a Class 7 milk class to price products including protein concentrates, skim milk powder and whole milk powder. The newly created milk class is priced at the lower of skim milk powder or whole milk powder prices observed throughout major dairy exporting regions, effectively guaranteeing that Canadian product will always be competitive globally.

USDA expects Canadian SMP/NFDM export volumes will continue to remain near the 2017 record high levels, however the Canadian government recently agreed to eliminate the Class 7 milk class as part of the United States-Mexico-Canada Agreement (USMCA). Under the USMCA, Canadian skim milk powder, milk protein concentrate and infant formula will be priced at U.S. price levels instead of the lowest of prices experienced throughout the major dairy exporting regions. Under the USMCA, the Canadian Class 7 milk class must be eliminated six months after the agreement is signed into order. In addition to abolishing Canada’s Class 7 milk class, the United States-Mexico-Canada Agreement also provides the U.S. producers with access to approximately 3.6% of Canada’s dairy market under a tariff-free quota.

Canadian net dairy imports have traditionally been led by butter and cheese, while Canada has remained a net exporter of skim milk powder/nonfat dry milk. Canadian SMP/NFDM export volumes increased significantly throughout 2017, aided by the introduction of newly created class of milk. In Mar ’17, Canada created a Class 7 milk class to price products including protein concentrates, skim milk powder and whole milk powder. The newly created milk class is priced at the lower of skim milk powder or whole milk powder prices observed throughout major dairy exporting regions, effectively guaranteeing that Canadian product will always be competitive globally.

USDA expects Canadian SMP/NFDM export volumes will continue to remain near the 2017 record high levels, however the Canadian government recently agreed to eliminate the Class 7 milk class as part of the United States-Mexico-Canada Agreement (USMCA). Under the USMCA, Canadian skim milk powder, milk protein concentrate and infant formula will be priced at U.S. price levels instead of the lowest of prices experienced throughout the major dairy exporting regions. Under the USMCA, the Canadian Class 7 milk class must be eliminated six months after the agreement is signed into order. In addition to abolishing Canada’s Class 7 milk class, the United States-Mexico-Canada Agreement also provides the U.S. producers with access to approximately 3.6% of Canada’s dairy market under a tariff-free quota.