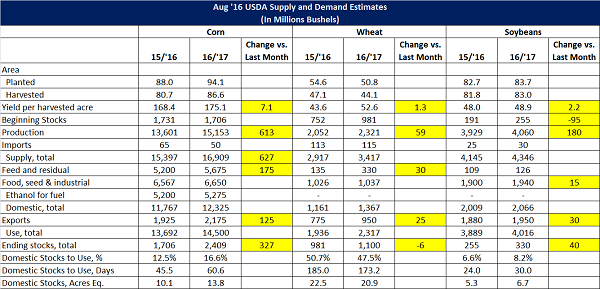

August ’16 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’15/’16 Corn

• Exports were revised higher by 25 million offsetting a 25 million bushel decline in ethanol usage.

• Ending stocks came in at 1.706 billion which was in line with expectations.

’16/’17 Corn

• Production was revised 613 million bushels higher based on a forecasted record yield of 175.1 bushels per acre that was well above expectations.

• Exports were projected 125 million higher on a very robust early season sales pace.

• Feed and residual usage increase 175 million as a larger crop is expected to increase the residual.

• Ending stocks at 2.409 billion bushels or 60.6 days of use was above private estimates and highest in almost 30 years.

’15/’16 Soybeans

• Exports were increased 85 million and crush by 10 million leaving demand much higher than expected.

• Ending stocks came in well below expectations at 255 million bushels or 24 days of use.

’16/’17 Soybeans

• Production was revised 180 million bushels higher based on record yields above expectations.

• Higher production offset lower beginning stocks and higher crush and exports by 15 and 30 million bu.

• Ending stocks at 330 million bushels or 30.0 days of use was in line with private estimates.

’15/’16 Wheat

• No significant changes.

’16/’17 Wheat

• Production was slightly higher on increasing yields offsetting greater feed and export usage.

• Ending stocks at 1,100 million bushels was slightly below trade estimates.

World Estimates

• World coarse grain production is forecasted to rebound back to record highs in 16/17 after the Brazil drought driven declines in the current production season leaving world ending stocks sharply higher.

• Wheat production increases in Russia and Ukraine offset lower EU output leaving world production up.

Click below to download the report.

August ’16 USDA World Agriculture Supply and Demand Estimates

*Significant changes are highlighted

’15/’16 Corn

• Exports were revised higher by 25 million offsetting a 25 million bushel decline in ethanol usage.

• Ending stocks came in at 1.706 billion which was in line with expectations.

’16/’17 Corn

• Production was revised 613 million bushels higher based on a forecasted record yield of 175.1 bushels per acre that was well above expectations.

• Exports were projected 125 million higher on a very robust early season sales pace.

• Feed and residual usage increase 175 million as a larger crop is expected to increase the residual.

• Ending stocks at 2.409 billion bushels or 60.6 days of use was above private estimates and highest in almost 30 years.

’15/’16 Soybeans

• Exports were increased 85 million and crush by 10 million leaving demand much higher than expected.

• Ending stocks came in well below expectations at 255 million bushels or 24 days of use.

’16/’17 Soybeans

• Production was revised 180 million bushels higher based on record yields above expectations.

• Higher production offset lower beginning stocks and higher crush and exports by 15 and 30 million bu.

• Ending stocks at 330 million bushels or 30.0 days of use was in line with private estimates.

’15/’16 Wheat

• No significant changes.

’16/’17 Wheat

• Production was slightly higher on increasing yields offsetting greater feed and export usage.

• Ending stocks at 1,100 million bushels was slightly below trade estimates.

World Estimates

• World coarse grain production is forecasted to rebound back to record highs in 16/17 after the Brazil drought driven declines in the current production season leaving world ending stocks sharply higher.

• Wheat production increases in Russia and Ukraine offset lower EU output leaving world production up.

Click below to download the report.

August ’16 USDA World Agriculture Supply and Demand Estimates