Chinese Dairy Imports Update – Apr ’20

Executive Summary

Chinese dairy import figures provided by IHS Markit were recently updated with values spanning through Mar ’20. Highlights from the updated report include:

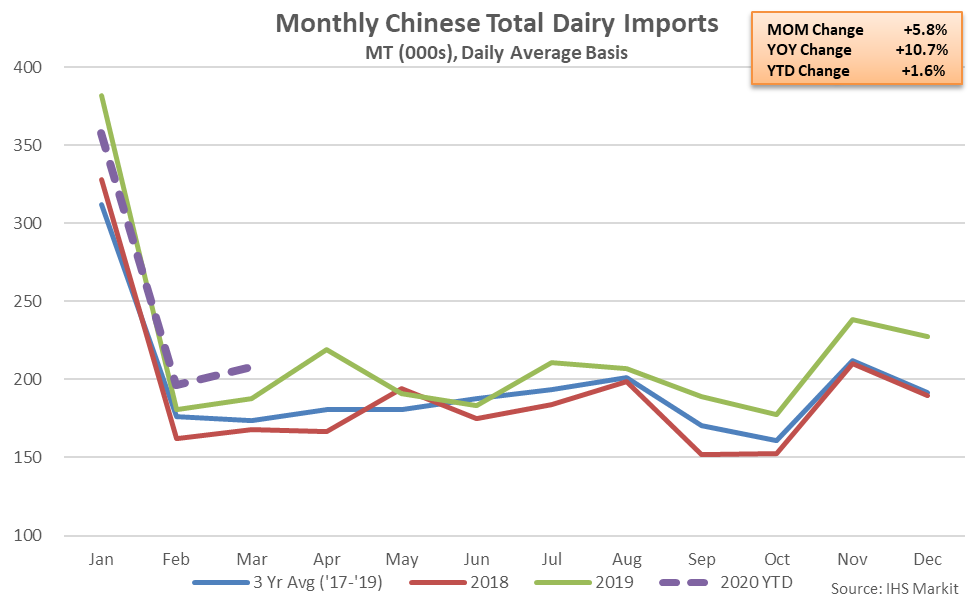

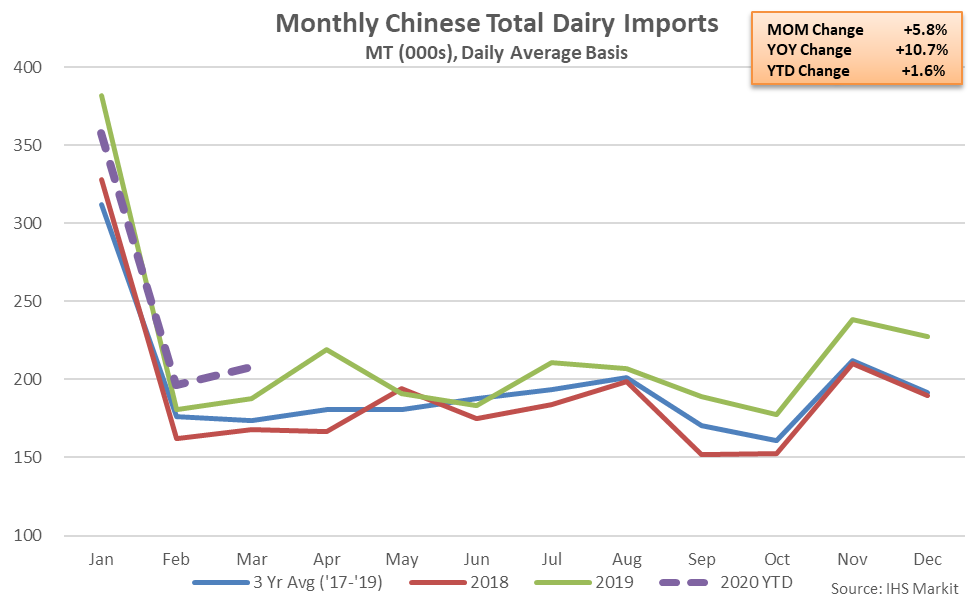

Mar ’20 Chinese Dairy Import Volumes Increased 5.8% MOM and 10.7% YOY

Mar ’20 Chinese Dairy Import Volumes Increased 5.8% MOM and 10.7% YOY

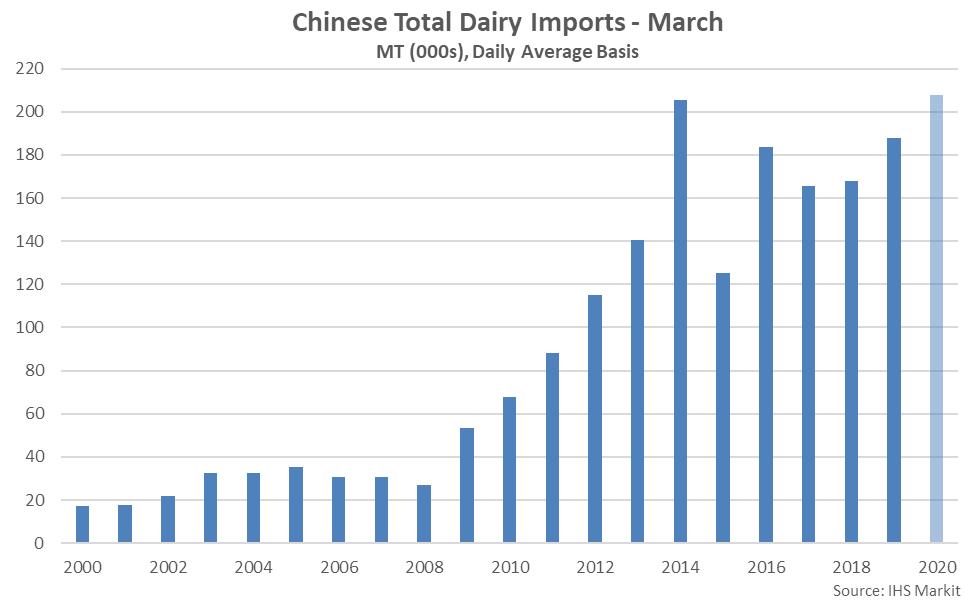

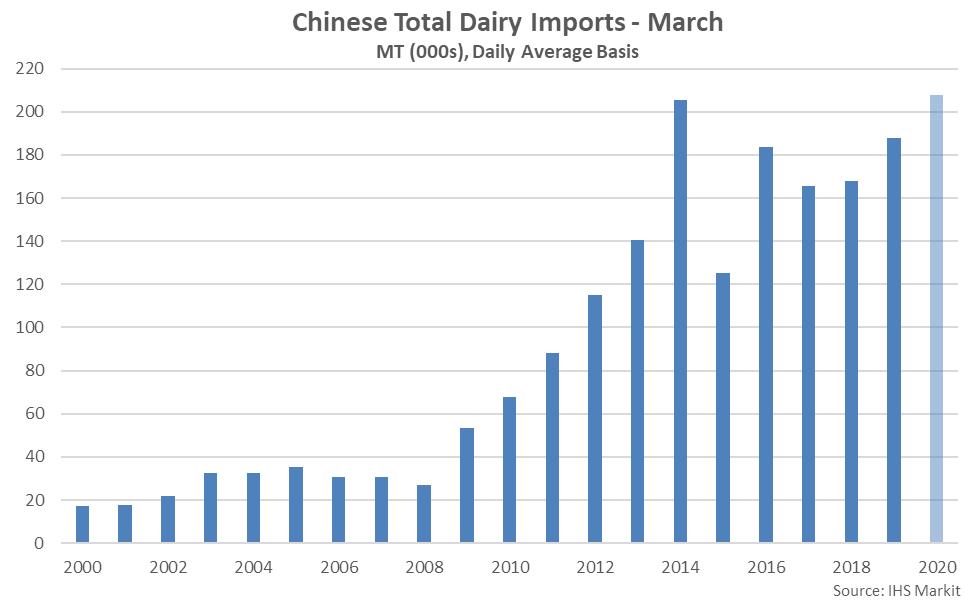

Mar ’20 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Mar ’20 Total Chinese Dairy Imports Reached a Record High Seasonal Level

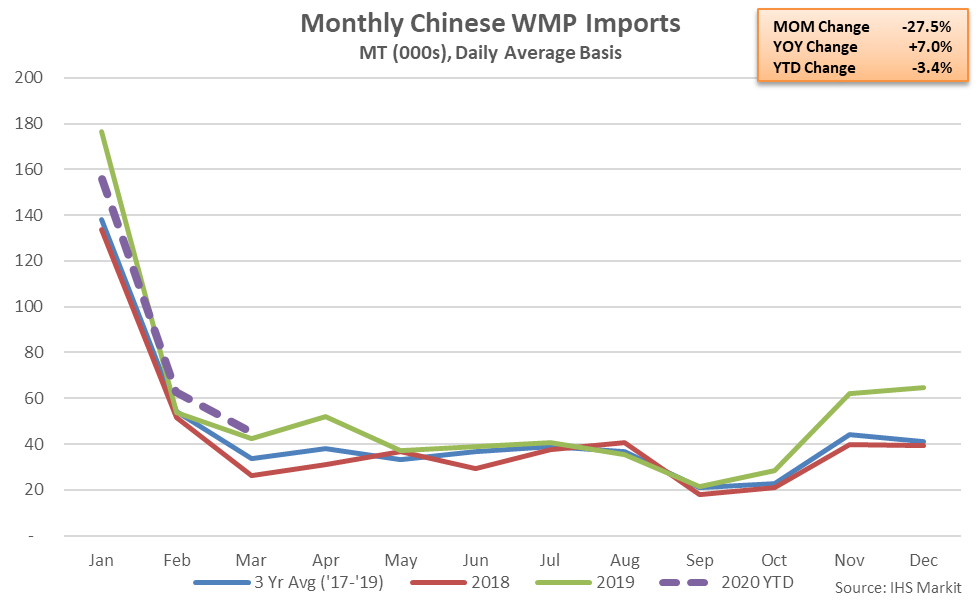

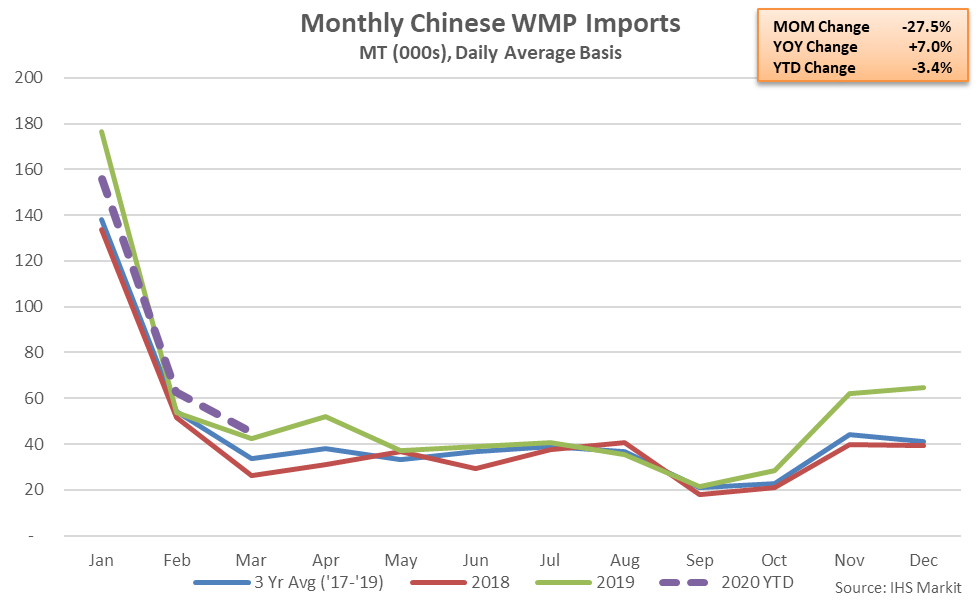

Mar ’20 Chinese WMP Import Volumes Declined 27.5% MOM but Remained up 7.0% YOY

Mar ’20 Chinese WMP Import Volumes Declined 27.5% MOM but Remained up 7.0% YOY

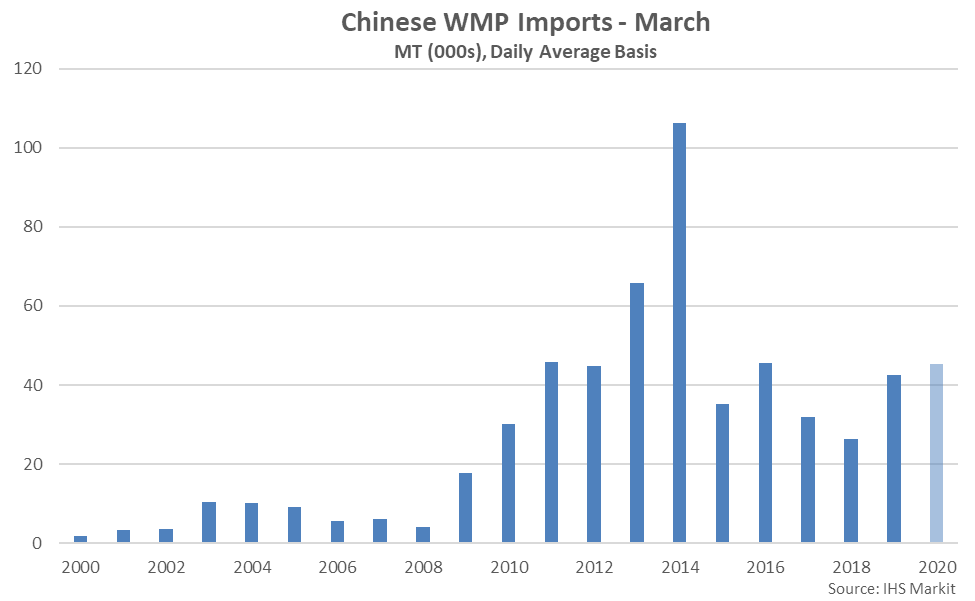

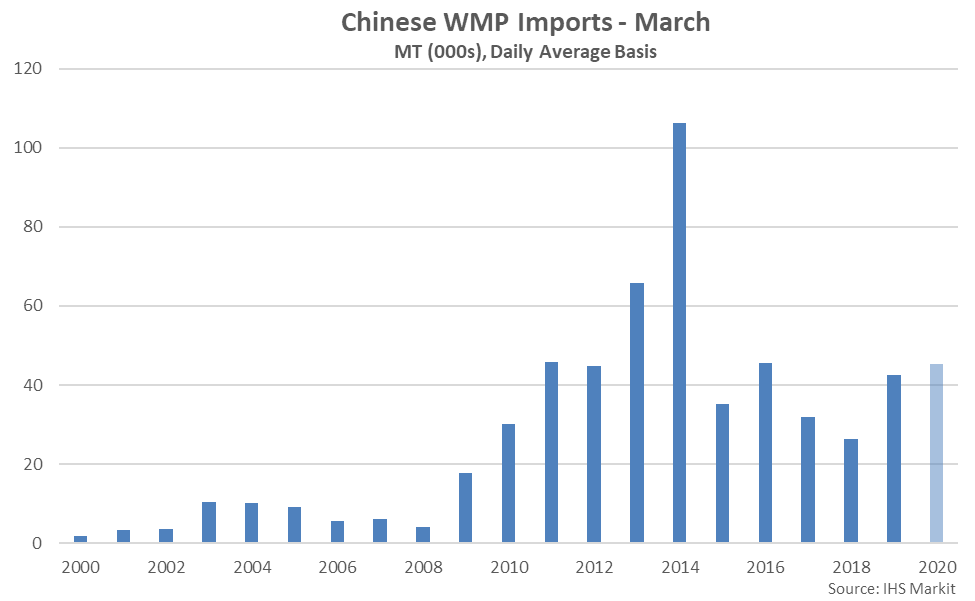

Mar ’20 Chinese WMP Imports Reached a Four Year High Seasonal Level

Mar ’20 Chinese WMP Imports Reached a Four Year High Seasonal Level

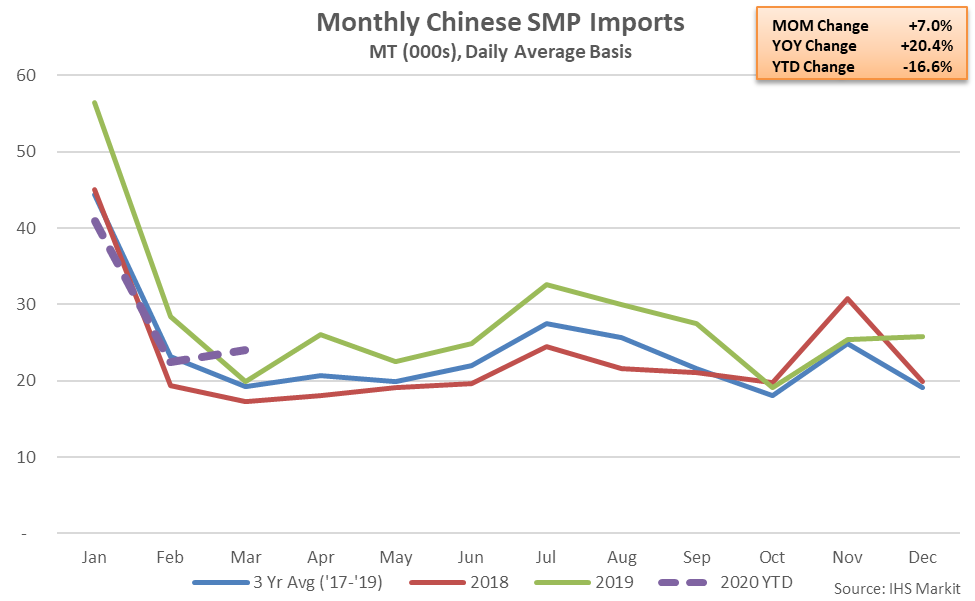

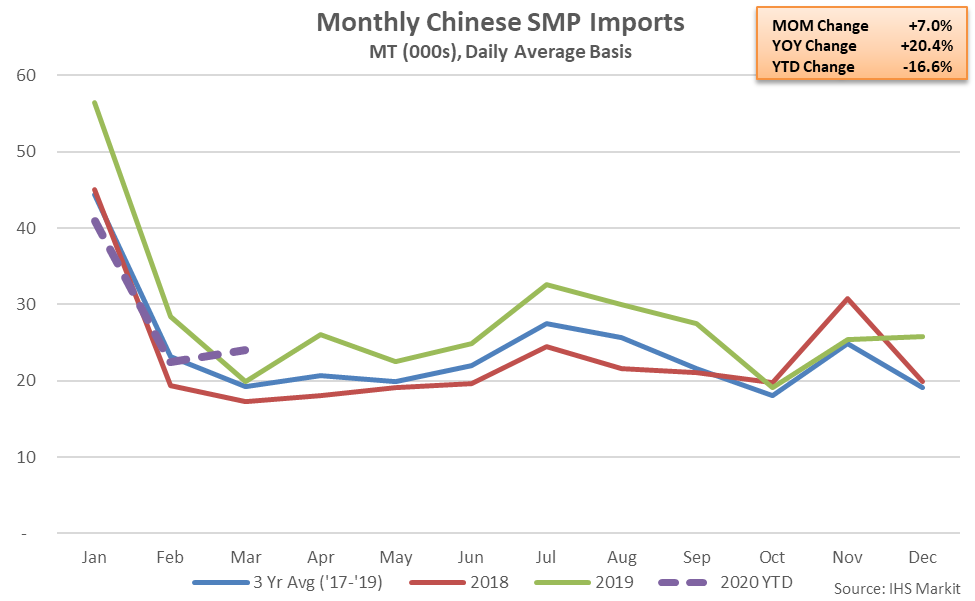

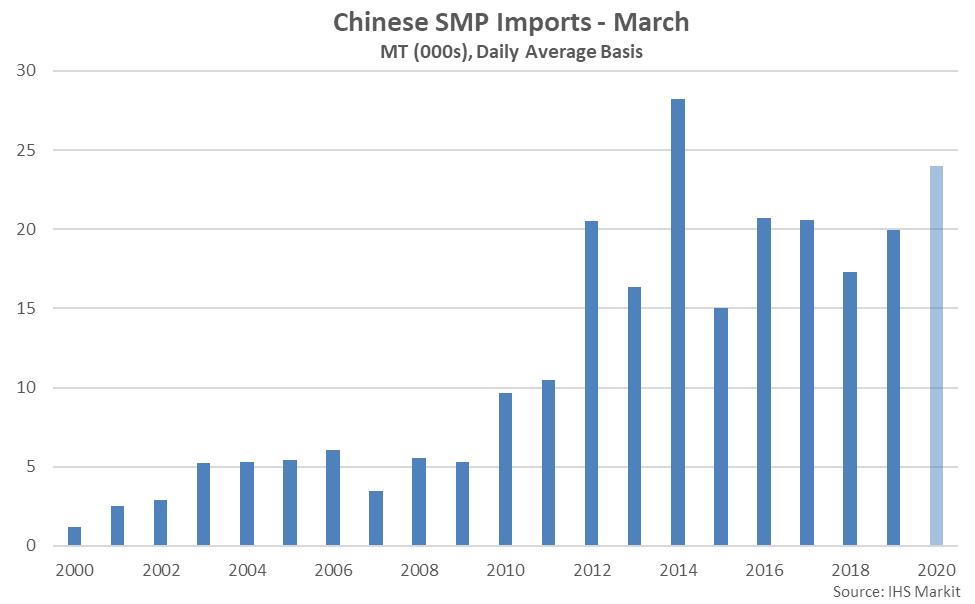

Mar ’20 Chinese SMP Import Volumes Increased 7.0% MOM and 20.4% YOY

Mar ’20 Chinese SMP Import Volumes Increased 7.0% MOM and 20.4% YOY

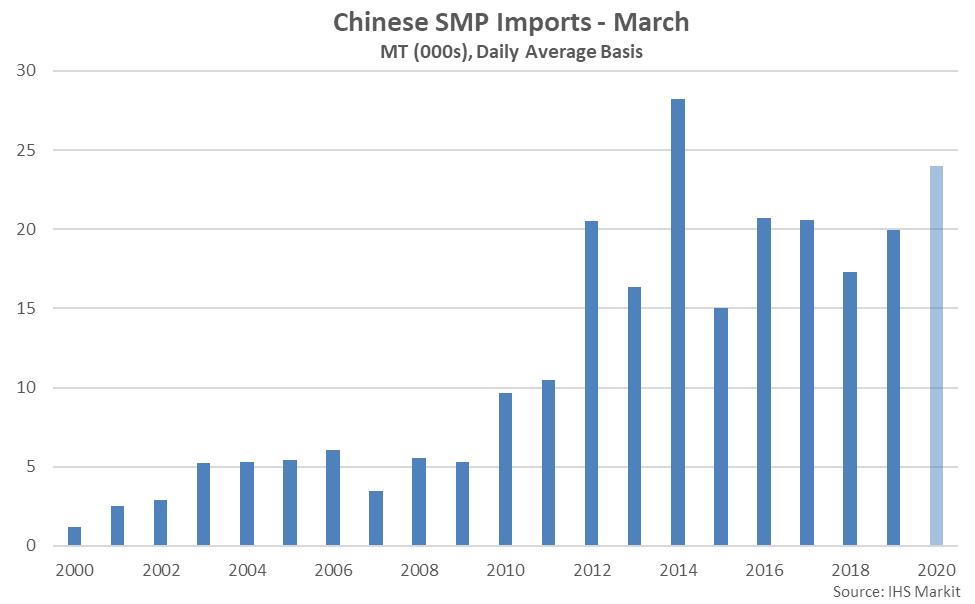

Mar ’20 Chinese SMP Imports Reached a Six Year High Seasonal Level

Mar ’20 Chinese SMP Imports Reached a Six Year High Seasonal Level

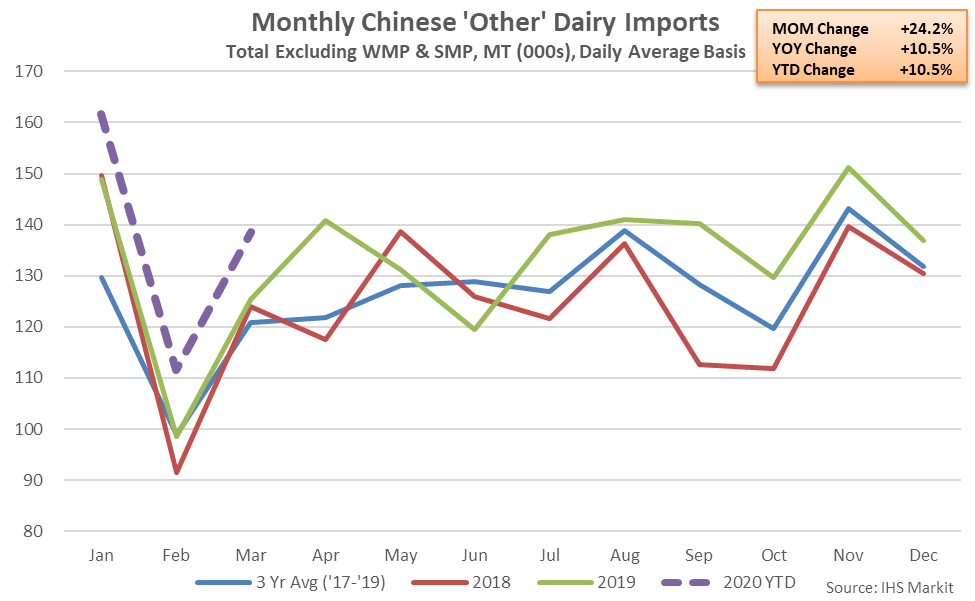

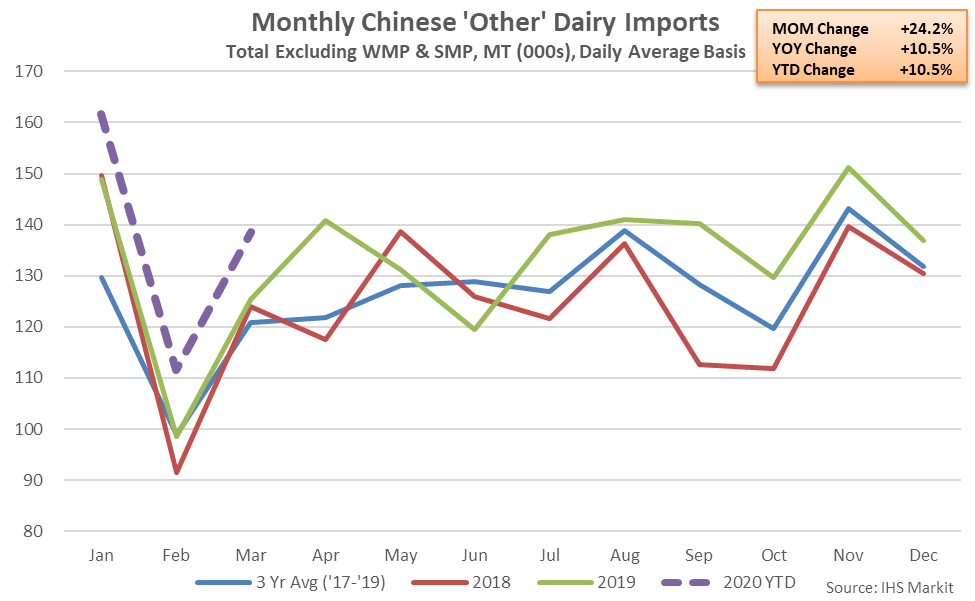

Mar ’20 Chinese Dairy Imports Excluding WMP & SMP Increased 24.2% MOM and 10.5% YOY

Mar ’20 Chinese Dairy Imports Excluding WMP & SMP Increased 24.2% MOM and 10.5% YOY

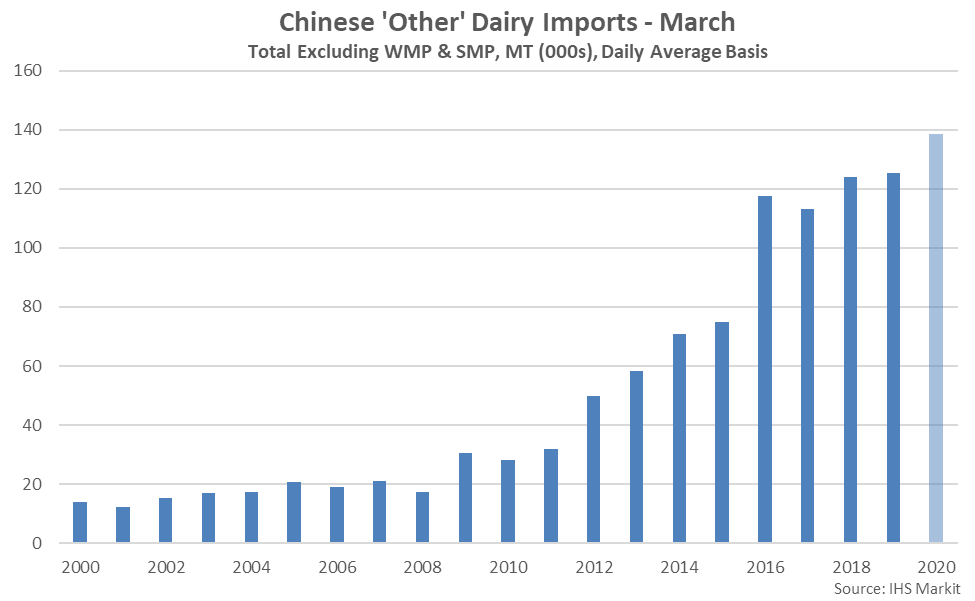

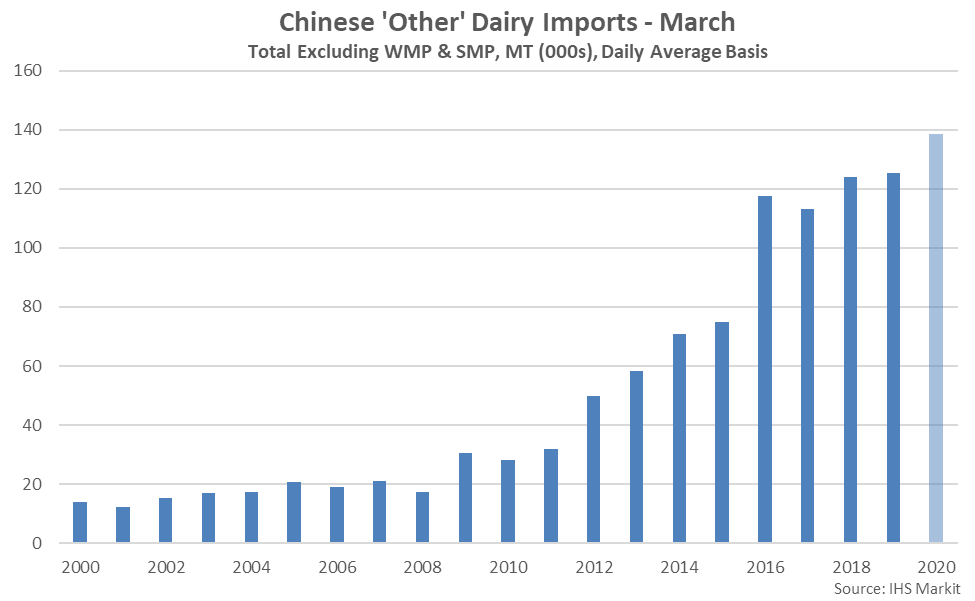

Mar ’20 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Mar ’20 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

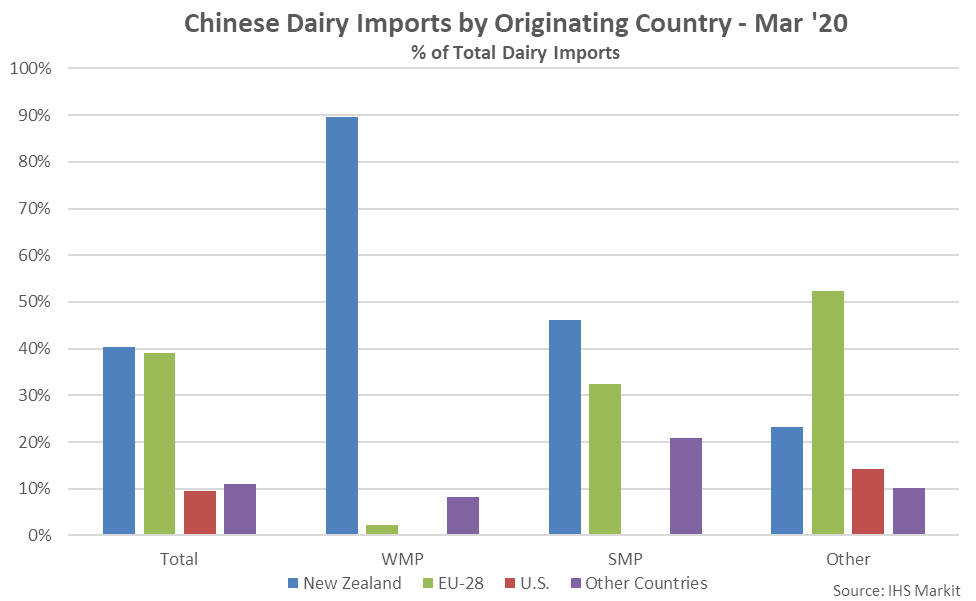

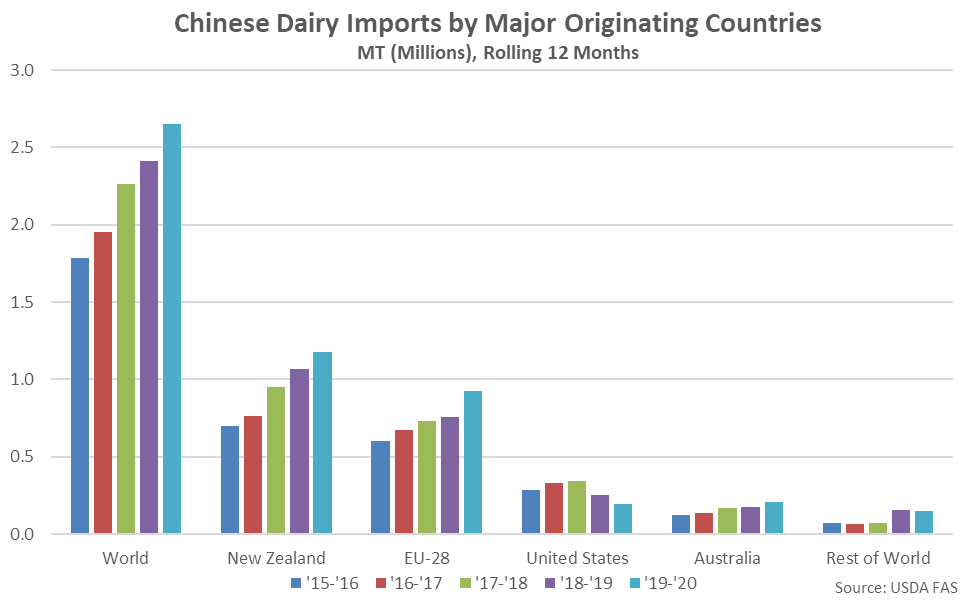

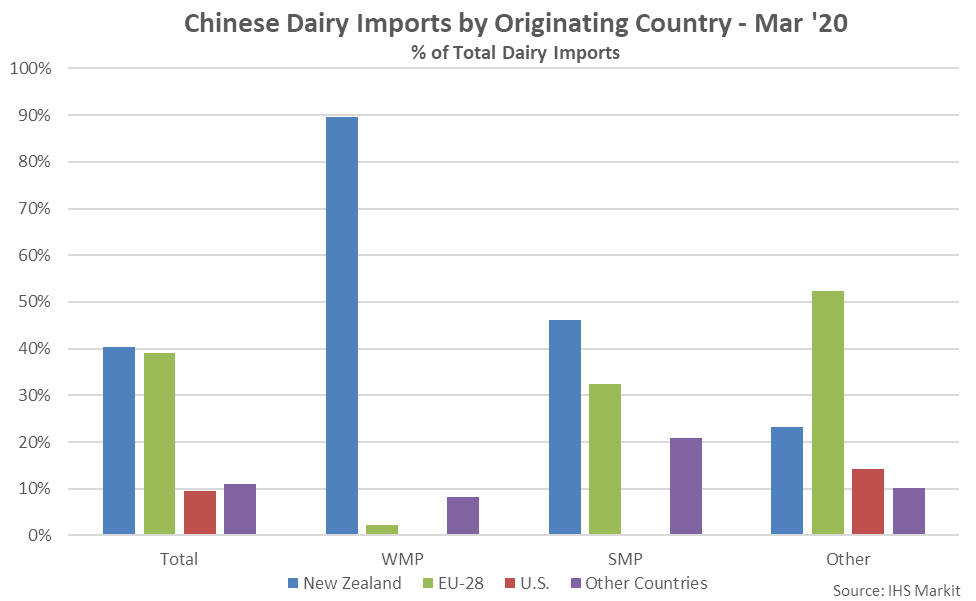

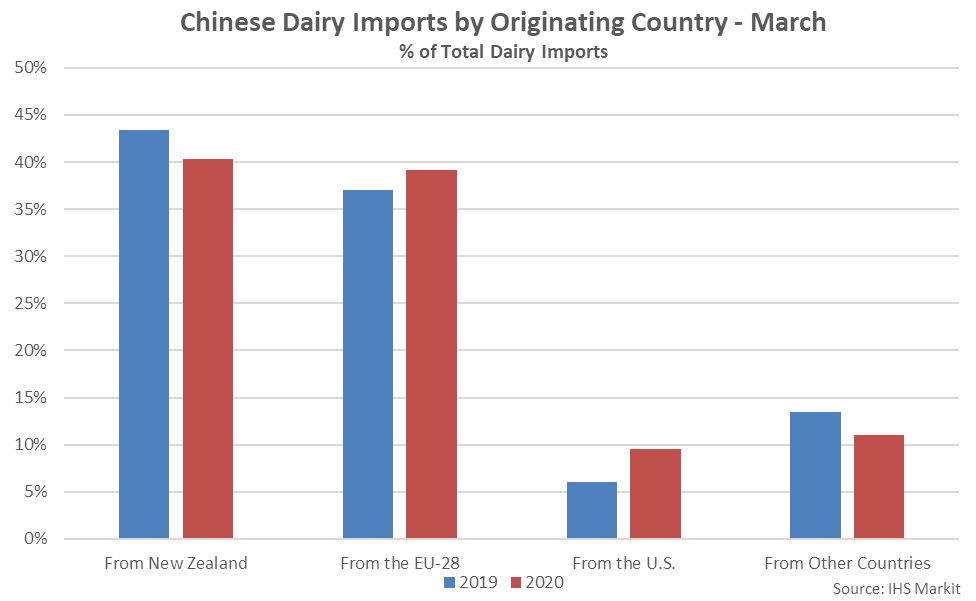

NZ & the EU-28 Each Accounted for Over a Third of All Mar ’20 Chinese Dairy Import Volumes

NZ & the EU-28 Each Accounted for Over a Third of All Mar ’20 Chinese Dairy Import Volumes

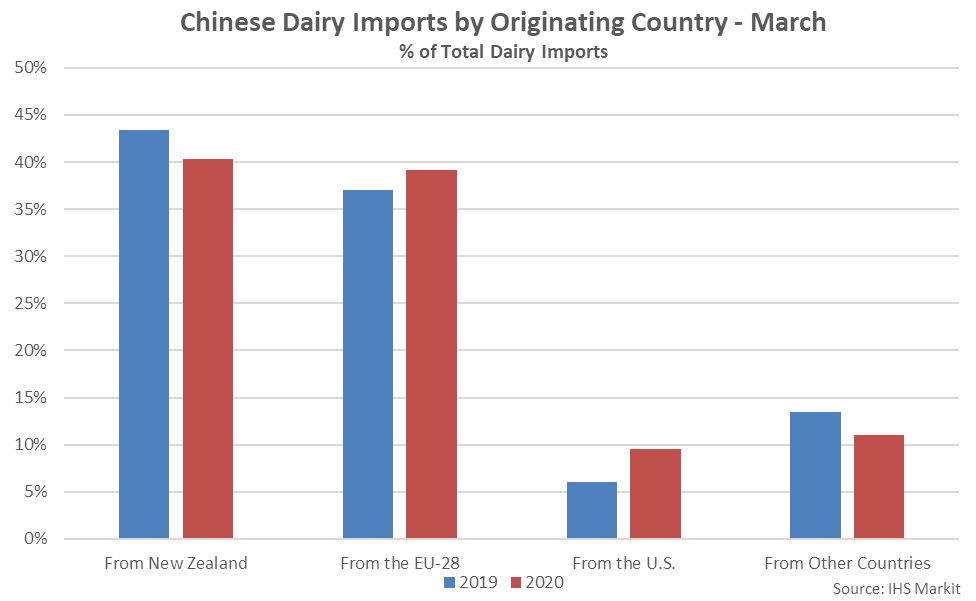

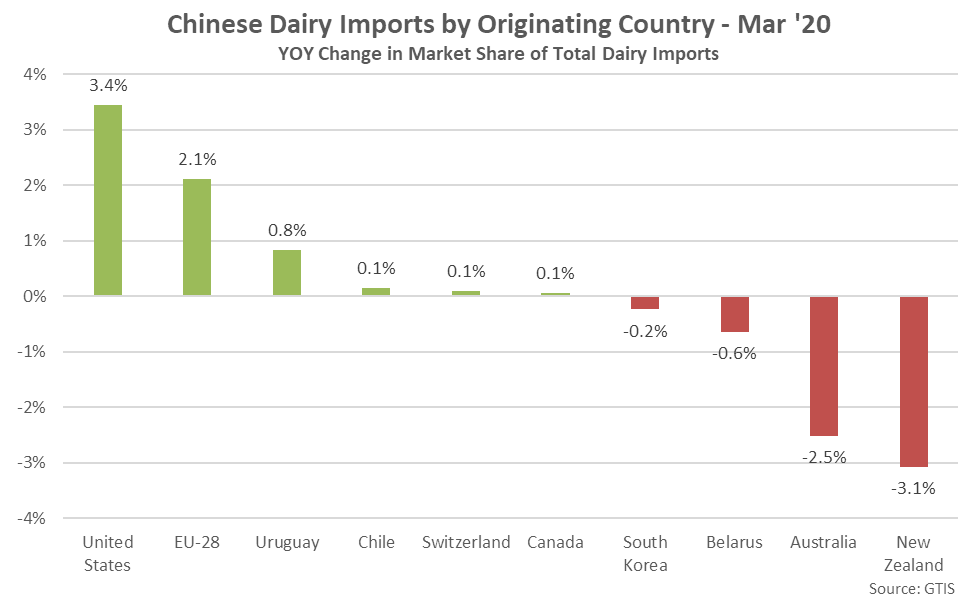

Mar ’20 EU-28 & U.S. Shares of Total Chinese Dairy Imports Finished Higher YOY

Mar ’20 EU-28 & U.S. Shares of Total Chinese Dairy Imports Finished Higher YOY

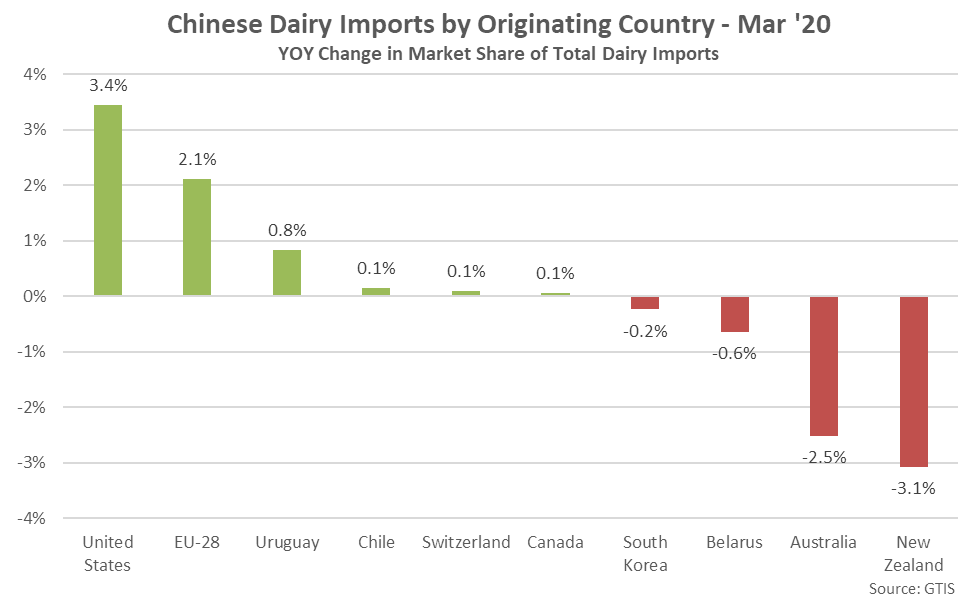

Mar ’20 U.S. Share of Total Chinese Dairy Imports Increased Most Significantly YOY

Mar ’20 U.S. Share of Total Chinese Dairy Imports Increased Most Significantly YOY

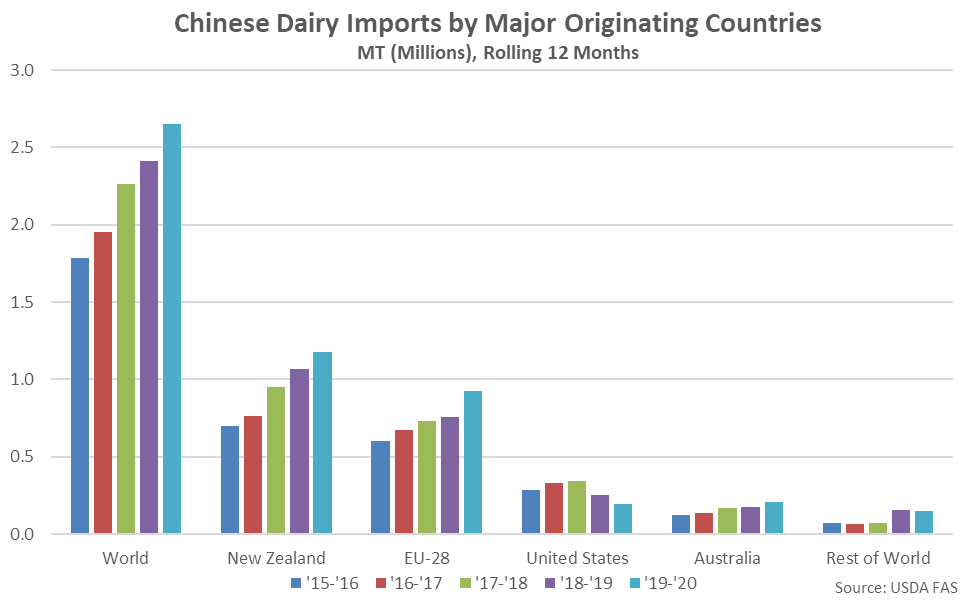

Chinese Dairy Imports From the EU-28 and NZ up Most Significantly Over the Past 12 Months

Chinese Dairy Imports From the EU-28 and NZ up Most Significantly Over the Past 12 Months

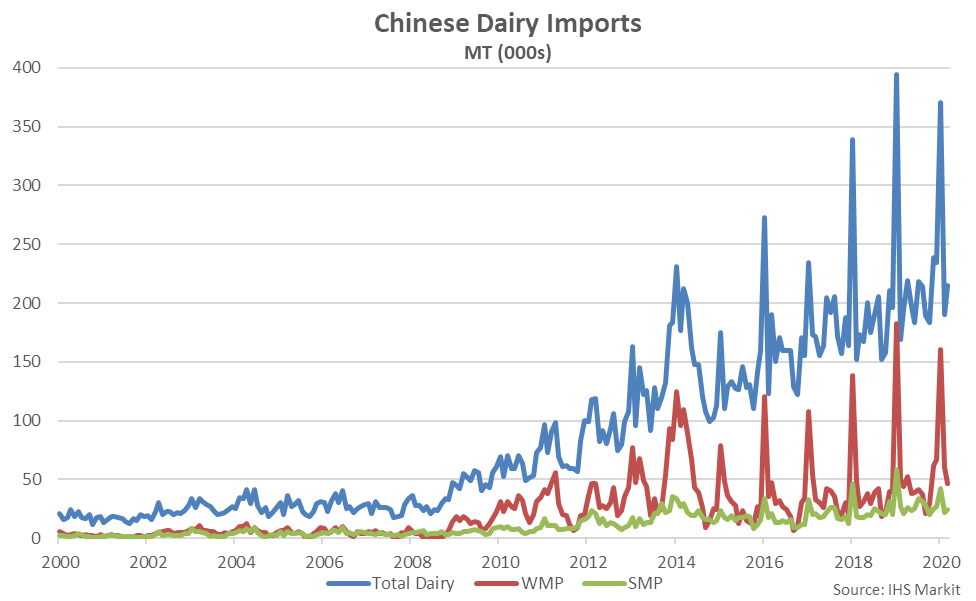

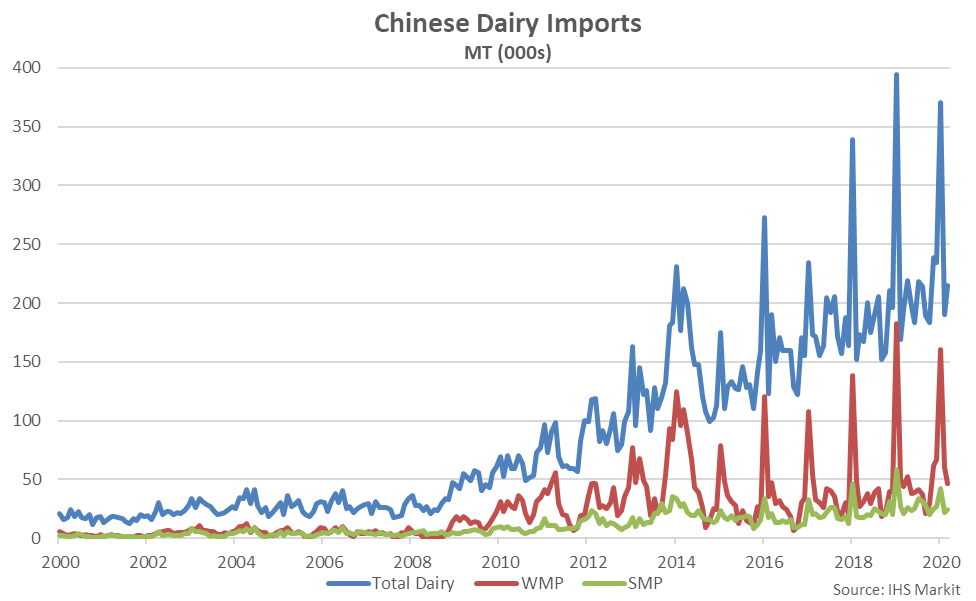

- Chinese dairy import volumes increased on a YOY basis for the 16th time in the past 18 months during Mar ’20, finishing up 10.7% and reaching a record high seasonal level.

- Chinese whole milk powder and skim milk powder import volumes remained higher on a YOY basis throughout Mar ’20, increasing by 7.0% and 20.4%, respectively. Mar ’20 Chinese dairy imports excluding whole milk powder and skim milk powder increased 10.5% YOY, reaching a record high seasonal level.

- Mar ’20 Chinese dairy imports originating from within the U.S. and EU-28 gained market share from the previous year, while Chinese dairy imports originating from within New Zealand and Australia finished most significantly below previous year volumes.

Mar ’20 Chinese Dairy Import Volumes Increased 5.8% MOM and 10.7% YOY

Mar ’20 Chinese Dairy Import Volumes Increased 5.8% MOM and 10.7% YOY

Mar ’20 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Mar ’20 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Mar ’20 Chinese WMP Import Volumes Declined 27.5% MOM but Remained up 7.0% YOY

Mar ’20 Chinese WMP Import Volumes Declined 27.5% MOM but Remained up 7.0% YOY

Mar ’20 Chinese WMP Imports Reached a Four Year High Seasonal Level

Mar ’20 Chinese WMP Imports Reached a Four Year High Seasonal Level

Mar ’20 Chinese SMP Import Volumes Increased 7.0% MOM and 20.4% YOY

Mar ’20 Chinese SMP Import Volumes Increased 7.0% MOM and 20.4% YOY

Mar ’20 Chinese SMP Imports Reached a Six Year High Seasonal Level

Mar ’20 Chinese SMP Imports Reached a Six Year High Seasonal Level

Mar ’20 Chinese Dairy Imports Excluding WMP & SMP Increased 24.2% MOM and 10.5% YOY

Mar ’20 Chinese Dairy Imports Excluding WMP & SMP Increased 24.2% MOM and 10.5% YOY

Mar ’20 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Mar ’20 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

NZ & the EU-28 Each Accounted for Over a Third of All Mar ’20 Chinese Dairy Import Volumes

NZ & the EU-28 Each Accounted for Over a Third of All Mar ’20 Chinese Dairy Import Volumes

Mar ’20 EU-28 & U.S. Shares of Total Chinese Dairy Imports Finished Higher YOY

Mar ’20 EU-28 & U.S. Shares of Total Chinese Dairy Imports Finished Higher YOY

Mar ’20 U.S. Share of Total Chinese Dairy Imports Increased Most Significantly YOY

Mar ’20 U.S. Share of Total Chinese Dairy Imports Increased Most Significantly YOY

Chinese Dairy Imports From the EU-28 and NZ up Most Significantly Over the Past 12 Months

Chinese Dairy Imports From the EU-28 and NZ up Most Significantly Over the Past 12 Months