U.S. Milk Production Projected Higher – Oct ’16

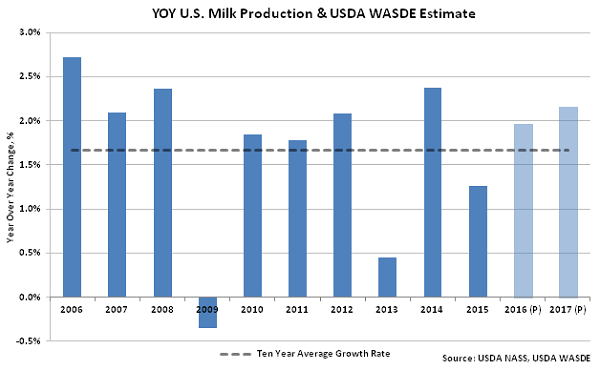

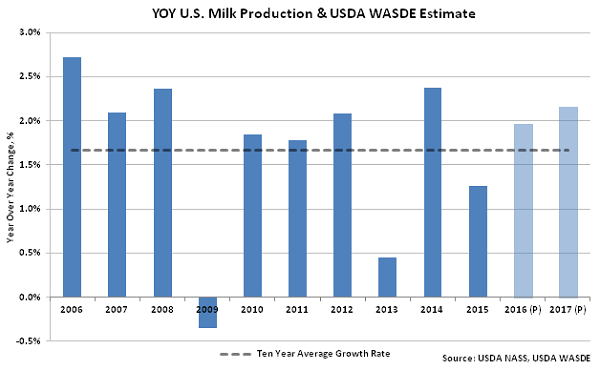

According to the October USDA World Agricultural Supply and Demand Estimate (WASDE) report, the 2016 U.S. milk production projection was raised for the second consecutive month as the cow inventory has grown more rapidly than previously expected. 2016 projected milk production of 212.7 billion pounds was raised by 0.5 billion pounds, finishing at the highest level projected within the past 11 months. 2016 projected production translates to a 2.0% increase from the 2015 production levels, which would be slightly above the ten year average growth rate. Projected milk production is expected to increase an additional 2.2% throughout 2017, finishing at an estimated level of 217.3 billion pounds, up 1.2 billion pounds from the previous month’s projection. Higher cow inventories also contributed to the increase in the 2017 milk production projection.

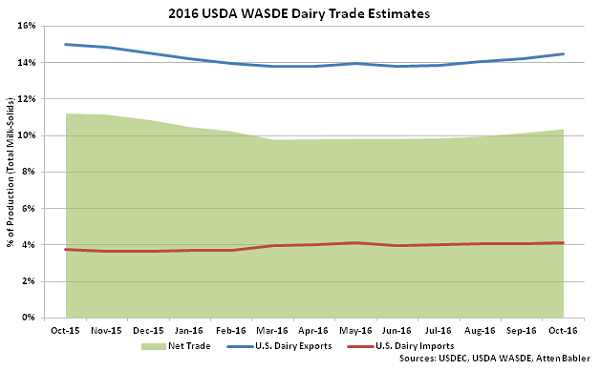

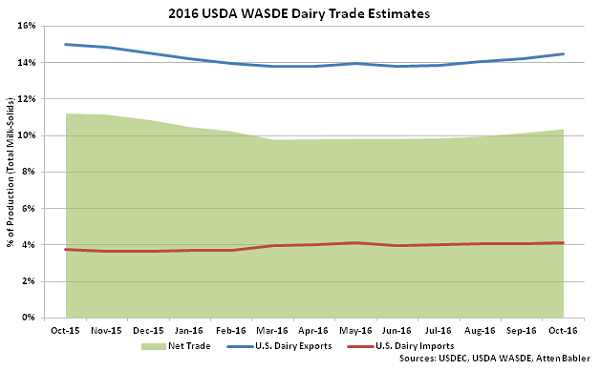

Export forecasts were raised for both 2016 and 2017 as increases in Oceania prices and relatively low U.S. prices are expected to make domestic product more competitive in world markets. Import forecasts were also raised for 2016 and 2017 on higher expected domestic demand. The 2016 projected dairy export volumes translated to 14.5% of total U.S. milk solids production while import volumes were equivalent to 4.1% of total U.S. milk solids production. U.S. net dairy trade projections increased to a nine month high of 10.4% during the October report. Ending stock projections were reduced as lower prices encourage increased demand from both export and domestic markets.

Export forecasts were raised for both 2016 and 2017 as increases in Oceania prices and relatively low U.S. prices are expected to make domestic product more competitive in world markets. Import forecasts were also raised for 2016 and 2017 on higher expected domestic demand. The 2016 projected dairy export volumes translated to 14.5% of total U.S. milk solids production while import volumes were equivalent to 4.1% of total U.S. milk solids production. U.S. net dairy trade projections increased to a nine month high of 10.4% during the October report. Ending stock projections were reduced as lower prices encourage increased demand from both export and domestic markets.

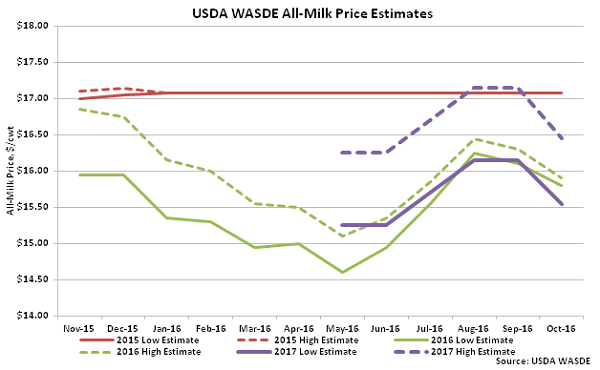

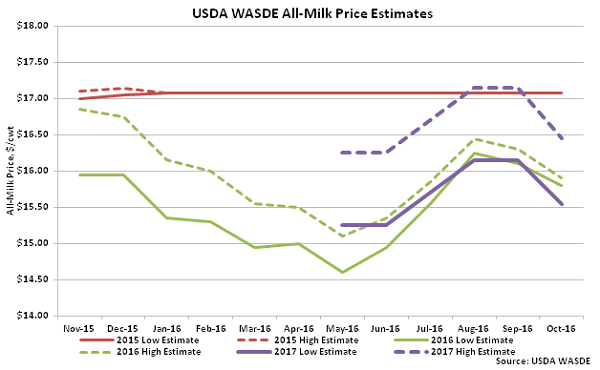

Butter and cheese prices were lowered for both 2016 and 2017 due to higher expected milk supplies however prices for nonfat dry milk (NFDM) and dry whey were forecast higher on increased competitiveness in export markets. The Class III price forecast was lowered by $0.50/cwt at the midpoint, finishing at $14.30-$14.40/cwt, as reductions in forecasted cheese prices more than offset the increase in forecasted dry whey prices, while the 2016 Class IV price forecast was lowered by $0.10/cwt at the midpoint, finishing at $13.60-$13.80/cwt, as the lower projected butter price more than offset the higher NFDM price. The 2016 All-Milk price forecast of $15.80-$15.90/cwt was lowered by $0.35/cwt at the midpoint, finishing 7.2% below 2015 price levels. The 2017 projected All-Milk price of $15.85-$16.00/cwt was lowered by $0.65/cwt at the midpoint, but remained 0.9% above 2016 price levels.

Butter and cheese prices were lowered for both 2016 and 2017 due to higher expected milk supplies however prices for nonfat dry milk (NFDM) and dry whey were forecast higher on increased competitiveness in export markets. The Class III price forecast was lowered by $0.50/cwt at the midpoint, finishing at $14.30-$14.40/cwt, as reductions in forecasted cheese prices more than offset the increase in forecasted dry whey prices, while the 2016 Class IV price forecast was lowered by $0.10/cwt at the midpoint, finishing at $13.60-$13.80/cwt, as the lower projected butter price more than offset the higher NFDM price. The 2016 All-Milk price forecast of $15.80-$15.90/cwt was lowered by $0.35/cwt at the midpoint, finishing 7.2% below 2015 price levels. The 2017 projected All-Milk price of $15.85-$16.00/cwt was lowered by $0.65/cwt at the midpoint, but remained 0.9% above 2016 price levels.

Export forecasts were raised for both 2016 and 2017 as increases in Oceania prices and relatively low U.S. prices are expected to make domestic product more competitive in world markets. Import forecasts were also raised for 2016 and 2017 on higher expected domestic demand. The 2016 projected dairy export volumes translated to 14.5% of total U.S. milk solids production while import volumes were equivalent to 4.1% of total U.S. milk solids production. U.S. net dairy trade projections increased to a nine month high of 10.4% during the October report. Ending stock projections were reduced as lower prices encourage increased demand from both export and domestic markets.

Export forecasts were raised for both 2016 and 2017 as increases in Oceania prices and relatively low U.S. prices are expected to make domestic product more competitive in world markets. Import forecasts were also raised for 2016 and 2017 on higher expected domestic demand. The 2016 projected dairy export volumes translated to 14.5% of total U.S. milk solids production while import volumes were equivalent to 4.1% of total U.S. milk solids production. U.S. net dairy trade projections increased to a nine month high of 10.4% during the October report. Ending stock projections were reduced as lower prices encourage increased demand from both export and domestic markets.

Butter and cheese prices were lowered for both 2016 and 2017 due to higher expected milk supplies however prices for nonfat dry milk (NFDM) and dry whey were forecast higher on increased competitiveness in export markets. The Class III price forecast was lowered by $0.50/cwt at the midpoint, finishing at $14.30-$14.40/cwt, as reductions in forecasted cheese prices more than offset the increase in forecasted dry whey prices, while the 2016 Class IV price forecast was lowered by $0.10/cwt at the midpoint, finishing at $13.60-$13.80/cwt, as the lower projected butter price more than offset the higher NFDM price. The 2016 All-Milk price forecast of $15.80-$15.90/cwt was lowered by $0.35/cwt at the midpoint, finishing 7.2% below 2015 price levels. The 2017 projected All-Milk price of $15.85-$16.00/cwt was lowered by $0.65/cwt at the midpoint, but remained 0.9% above 2016 price levels.

Butter and cheese prices were lowered for both 2016 and 2017 due to higher expected milk supplies however prices for nonfat dry milk (NFDM) and dry whey were forecast higher on increased competitiveness in export markets. The Class III price forecast was lowered by $0.50/cwt at the midpoint, finishing at $14.30-$14.40/cwt, as reductions in forecasted cheese prices more than offset the increase in forecasted dry whey prices, while the 2016 Class IV price forecast was lowered by $0.10/cwt at the midpoint, finishing at $13.60-$13.80/cwt, as the lower projected butter price more than offset the higher NFDM price. The 2016 All-Milk price forecast of $15.80-$15.90/cwt was lowered by $0.35/cwt at the midpoint, finishing 7.2% below 2015 price levels. The 2017 projected All-Milk price of $15.85-$16.00/cwt was lowered by $0.65/cwt at the midpoint, but remained 0.9% above 2016 price levels.