U.S. Milk Production Projections Reduced for 2016 – Jan…

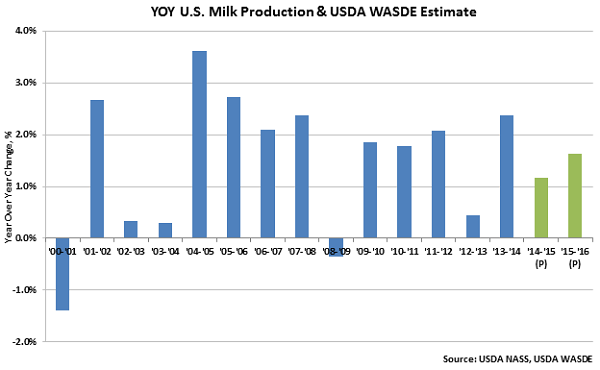

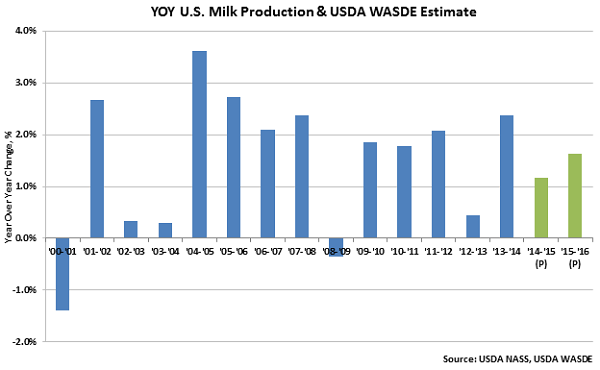

According to the January USDA World Agricultural Supply and Demand Estimate (WASDE) report, projected U.S. milk production was raised slightly for 2015 on stronger growth in milk per cow yields but lowered for 2016 due to lower than expected milk prices and the recent blizzard in Texas and New Mexico. 2015 projected milk production of 208.4 billion pounds was raised by 0.1 billion pounds from the lowest projection on record experienced in the previous month. 2015 projected milk production equates to a 1.2% YOY increase from 2014 production levels and a 0.3% implied YOY increase in milk production over the final month of the year. 2016 projected milk production of 211.8 billion pounds was reduced by 0.3 billion pounds, reaching the lowest projected total on record. 2016 projected production translates to a 1.6% increase from the 2015 projected production levels.

Export forecasts were reduced for 2015 and 2016 on both a milk-fat and a skim-solids basis as global supplies of dairy products remains large and demand remains relatively weak. Declines in export forecasts on a milk-fat basis were most significantly reduced as continued strength in domestic butter markets will likely limit the competitiveness of U.S. butter in world markets. Import forecasts were unchanged for 2015 but raised for 2016 on both a milk-fat and skim-solids basis on higher cheese imports.

Butter prices were raised for 2016 on relatively strong demand and lower than expected production. Cheese prices were lowered for 2016 on large beginning stocks of cheese and weaker than expected beginning year prices. Whey and NFDM prices were also reduced for 2016 as prices are expected to be pressured by weakness in export markets.

Class III price estimates were unchanged at the midpoint for 2015, at $15.80/cwt, but were reduced by $0.70/cwt for 2016 to $14.05-$14.85/cwt on lower cheese and whey prices. Class IV price estimates were reduced $0.05/cwt at the midpoint for 2015 to $14.35/cwt and were reduced by $0.35/cwt for 2016 to $13.35-$14.25/cwt as a lower projected NFDM price is expected to more than offset a higher than projected butter price.

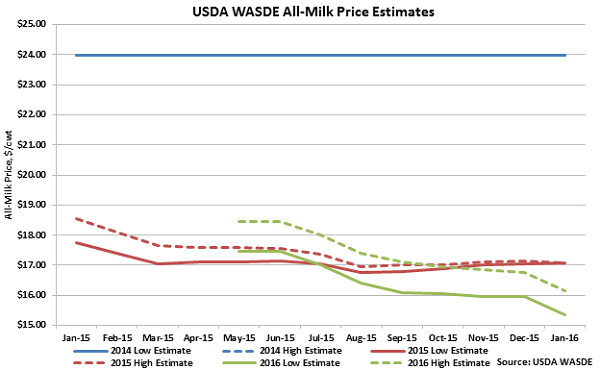

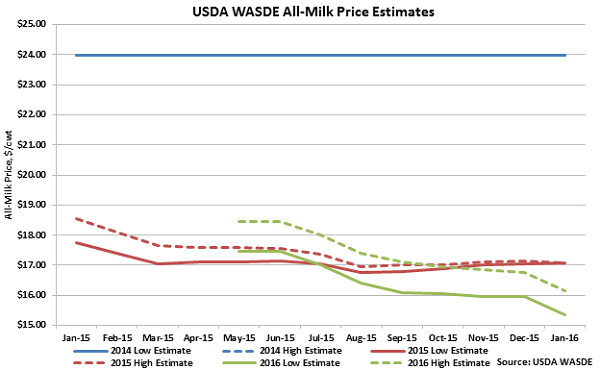

As shown in the chart below, the 2015 All-Milk projected price of $17.08/cwt finished significantly below the 2014 average All-Milk price of $23.98/cwt, down 28.8%. The 2016 All-Milk price forecast of $15.35-$16.15/cwt was reduced by $0.60/cwt, remaining below 2015 forecasted prices on both ends of the forecast for the fourth consecutive month. The $0.60/cwt decline was the largest experienced in the past five months.

Export forecasts were reduced for 2015 and 2016 on both a milk-fat and a skim-solids basis as global supplies of dairy products remains large and demand remains relatively weak. Declines in export forecasts on a milk-fat basis were most significantly reduced as continued strength in domestic butter markets will likely limit the competitiveness of U.S. butter in world markets. Import forecasts were unchanged for 2015 but raised for 2016 on both a milk-fat and skim-solids basis on higher cheese imports.

Butter prices were raised for 2016 on relatively strong demand and lower than expected production. Cheese prices were lowered for 2016 on large beginning stocks of cheese and weaker than expected beginning year prices. Whey and NFDM prices were also reduced for 2016 as prices are expected to be pressured by weakness in export markets.

Class III price estimates were unchanged at the midpoint for 2015, at $15.80/cwt, but were reduced by $0.70/cwt for 2016 to $14.05-$14.85/cwt on lower cheese and whey prices. Class IV price estimates were reduced $0.05/cwt at the midpoint for 2015 to $14.35/cwt and were reduced by $0.35/cwt for 2016 to $13.35-$14.25/cwt as a lower projected NFDM price is expected to more than offset a higher than projected butter price.

As shown in the chart below, the 2015 All-Milk projected price of $17.08/cwt finished significantly below the 2014 average All-Milk price of $23.98/cwt, down 28.8%. The 2016 All-Milk price forecast of $15.35-$16.15/cwt was reduced by $0.60/cwt, remaining below 2015 forecasted prices on both ends of the forecast for the fourth consecutive month. The $0.60/cwt decline was the largest experienced in the past five months.

Export forecasts were reduced for 2015 and 2016 on both a milk-fat and a skim-solids basis as global supplies of dairy products remains large and demand remains relatively weak. Declines in export forecasts on a milk-fat basis were most significantly reduced as continued strength in domestic butter markets will likely limit the competitiveness of U.S. butter in world markets. Import forecasts were unchanged for 2015 but raised for 2016 on both a milk-fat and skim-solids basis on higher cheese imports.

Butter prices were raised for 2016 on relatively strong demand and lower than expected production. Cheese prices were lowered for 2016 on large beginning stocks of cheese and weaker than expected beginning year prices. Whey and NFDM prices were also reduced for 2016 as prices are expected to be pressured by weakness in export markets.

Class III price estimates were unchanged at the midpoint for 2015, at $15.80/cwt, but were reduced by $0.70/cwt for 2016 to $14.05-$14.85/cwt on lower cheese and whey prices. Class IV price estimates were reduced $0.05/cwt at the midpoint for 2015 to $14.35/cwt and were reduced by $0.35/cwt for 2016 to $13.35-$14.25/cwt as a lower projected NFDM price is expected to more than offset a higher than projected butter price.

As shown in the chart below, the 2015 All-Milk projected price of $17.08/cwt finished significantly below the 2014 average All-Milk price of $23.98/cwt, down 28.8%. The 2016 All-Milk price forecast of $15.35-$16.15/cwt was reduced by $0.60/cwt, remaining below 2015 forecasted prices on both ends of the forecast for the fourth consecutive month. The $0.60/cwt decline was the largest experienced in the past five months.

Export forecasts were reduced for 2015 and 2016 on both a milk-fat and a skim-solids basis as global supplies of dairy products remains large and demand remains relatively weak. Declines in export forecasts on a milk-fat basis were most significantly reduced as continued strength in domestic butter markets will likely limit the competitiveness of U.S. butter in world markets. Import forecasts were unchanged for 2015 but raised for 2016 on both a milk-fat and skim-solids basis on higher cheese imports.

Butter prices were raised for 2016 on relatively strong demand and lower than expected production. Cheese prices were lowered for 2016 on large beginning stocks of cheese and weaker than expected beginning year prices. Whey and NFDM prices were also reduced for 2016 as prices are expected to be pressured by weakness in export markets.

Class III price estimates were unchanged at the midpoint for 2015, at $15.80/cwt, but were reduced by $0.70/cwt for 2016 to $14.05-$14.85/cwt on lower cheese and whey prices. Class IV price estimates were reduced $0.05/cwt at the midpoint for 2015 to $14.35/cwt and were reduced by $0.35/cwt for 2016 to $13.35-$14.25/cwt as a lower projected NFDM price is expected to more than offset a higher than projected butter price.

As shown in the chart below, the 2015 All-Milk projected price of $17.08/cwt finished significantly below the 2014 average All-Milk price of $23.98/cwt, down 28.8%. The 2016 All-Milk price forecast of $15.35-$16.15/cwt was reduced by $0.60/cwt, remaining below 2015 forecasted prices on both ends of the forecast for the fourth consecutive month. The $0.60/cwt decline was the largest experienced in the past five months.