U.S. Renewable Diesel Production Capacity Overview – Aug ’21

U.S. renewable diesel production capacity is expected to increase significantly throughout the next several years based on projects currently under construction or proposed. The following analysis provides an overview of current renewable diesel production volumes, under construction and proposed additional renewable diesel production capacity, and the potential effects on biomass-based diesel feedstock volumes.

Biomass-Based Diesel Production

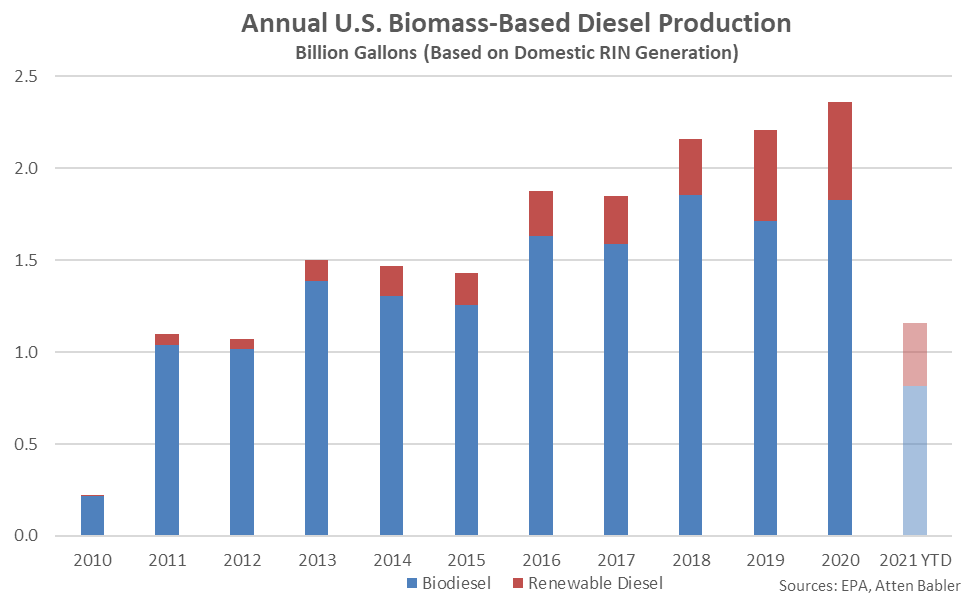

Total biomass-based diesel production has reached record high levels over three consecutive years through 2020. The chart below shows a breakout of U.S. conventional biodiesel and renewable diesel production based on domestic RIN generation. The EIA does not yet report renewable diesel production figures however annual conventional biodiesel figures derived from RIN data align well with EIA conventional biodiesel production figures, exhibiting a correlation coefficient of 0.99.

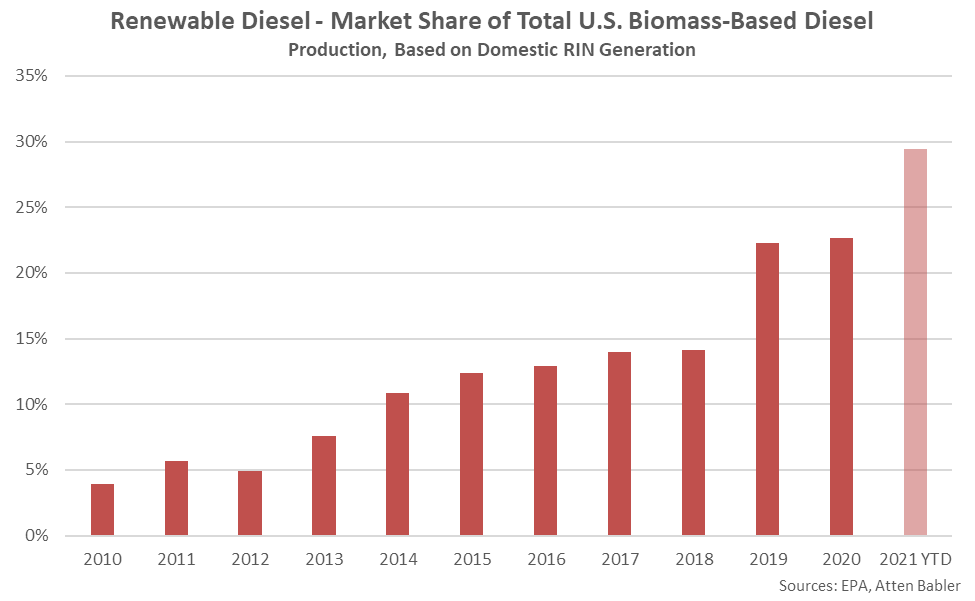

The renewable diesel share of total U.S. biomass-based diesel production has increased over eight consecutive years through 2020. The 2021 YTD renewable diesel share of total U.S. biomass-based diesel production is on pace to reach a record high level of nearly 30% based on RIN data available through the month of June.

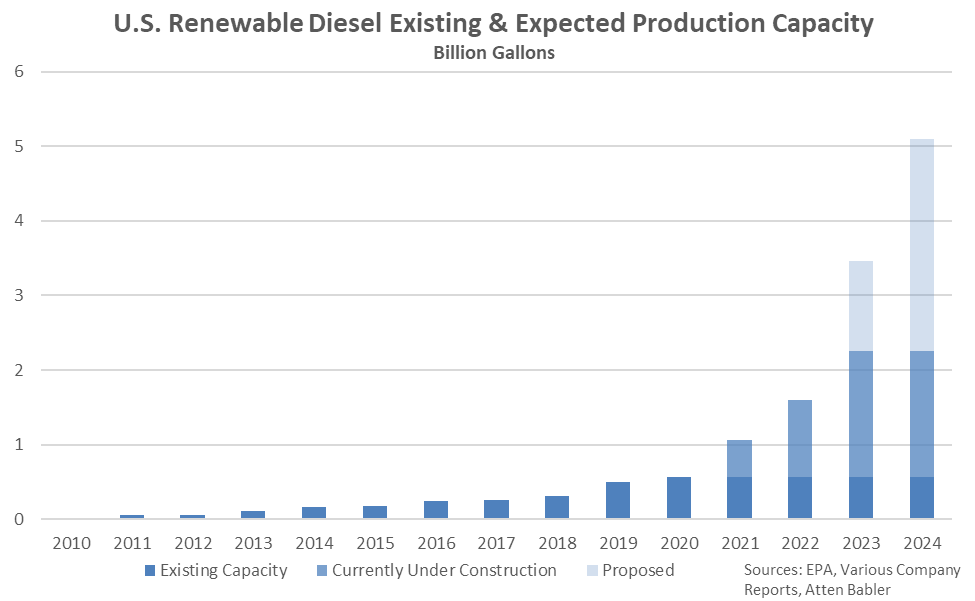

Announced Renewable Diesel Projects

U.S. renewable diesel production capacity is estimated to be approximately 600 million gallons as of the end of 2020. Per various company reports, 1.7 billion gallons of additional renewable diesel production capacity are under construction and 2.8 billion gallons of potential additional production capacity have been proposed through 2024. If all of these projects come online, total renewable diesel production capacity would increase by a factor of 8.5x through 2024, to a total of 5.1 billion gallons. The analysis above does not include an additional 600 million gallons of renewable diesel production proposed which are deemed less likely to happen or may happen depending on the success of other projects currently in the build stage.

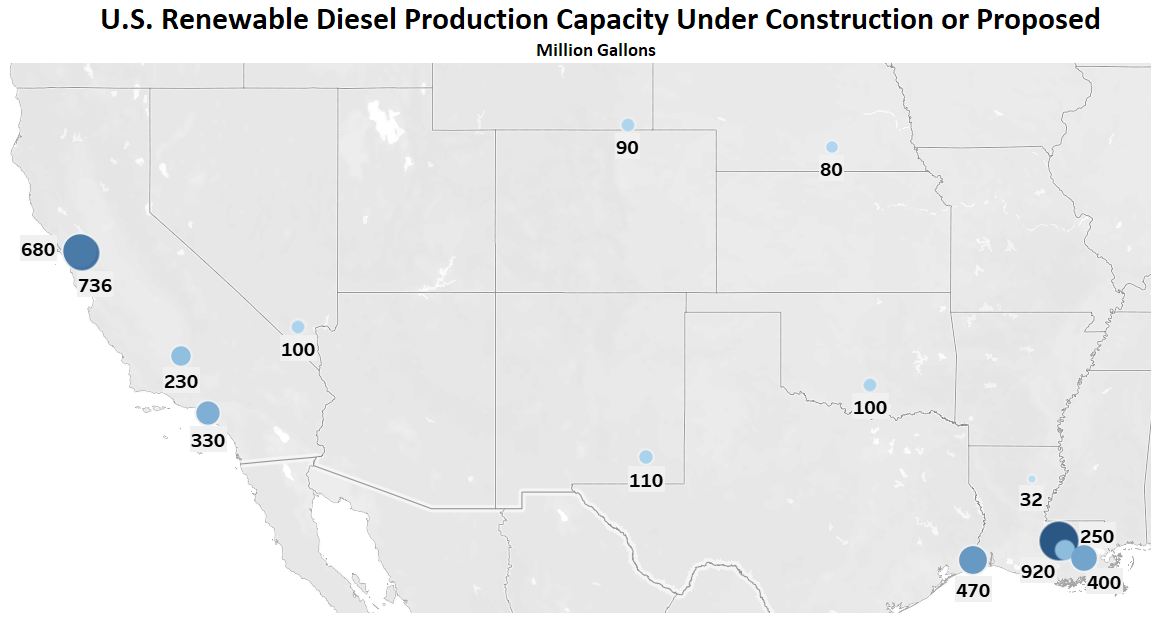

Approximately 90% of the additional renewable diesel production capacity under construction or proposed are California or Gulf of Mexico based.

Biomass-Based Diesel Feedstocks

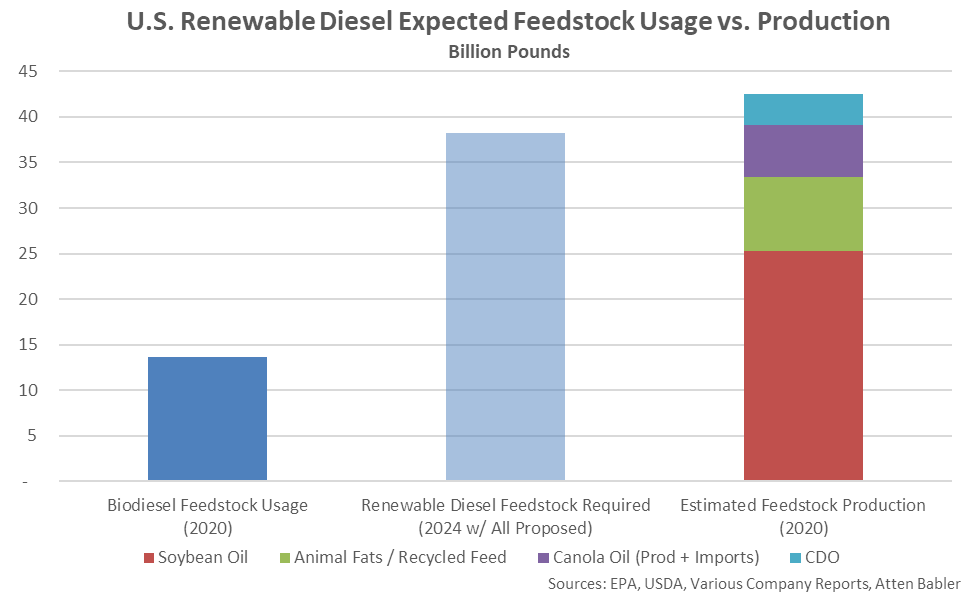

The 4.5 billion additional gallons of renewable diesel production capacity under construction or proposed creates an additional 34 billion pounds of required feedstock, or a total of 38 billion pounds of required feedstock when incorporating existing renewable diesel production. For perspective, conventional biodiesel used approximately 14 billion pounds of feedstock throughout 2020. The chart below compares potential required feedstock vs. estimated feedstock production (including imports for canola).

The analysis above results in 2024 potential renewable diesel production accounting for 90% of all biomass-based diesel feedstock produced throughout 2020. It should be noted that there are many moving parts to the analysis above, whether all proposed renewable diesel capacity will come online being the most significant. There has already been at least one conversion projected delayed due to high feedstock prices.

If examined solely from a soybean perspective, 2024 potential renewable diesel production would require an additional three billion bushels of beans, the equivalent of 1.5x the total volumes currently exported. 25 billion pounds of soybean oil were produced throughout 2020, although additional capacity is in the process of being added.