U.S. Acreage Update – Jun ’21

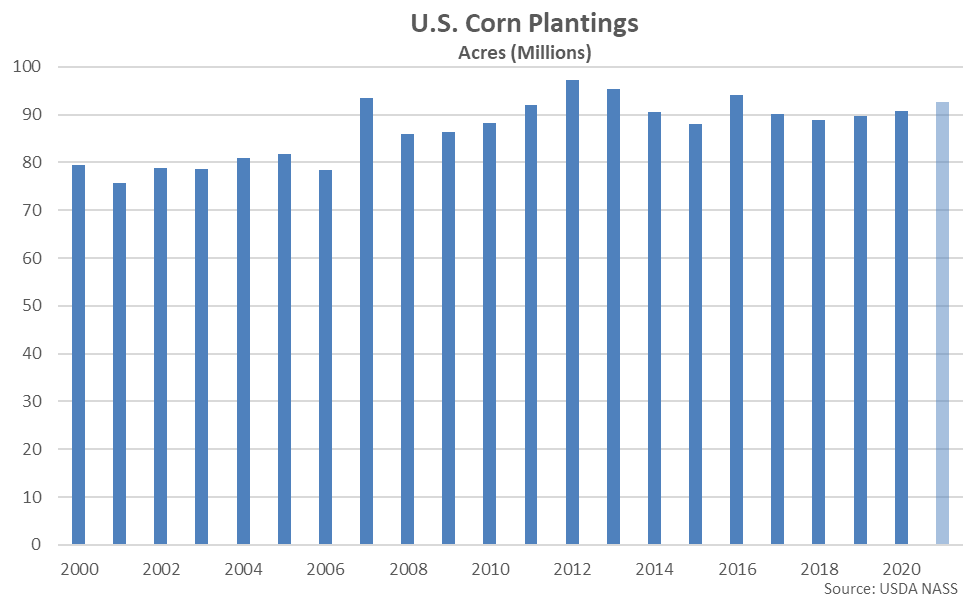

Corn – Planted Acres Increase to a Five Year High Level but Finish Below Expectations

According to the USDA’s June acreage report, corn planted acres for 2021 of 92.7 million acres finished 1.55 million acres, or 1.7%, above the March estimated figure and 1.9 million acres, or 2.1%, above the previous year figure, finishing at a five year high level. Corn plantings finished 1.1 million acres, or 1.2%, below analyst expectations of 93.8 million acres, however.

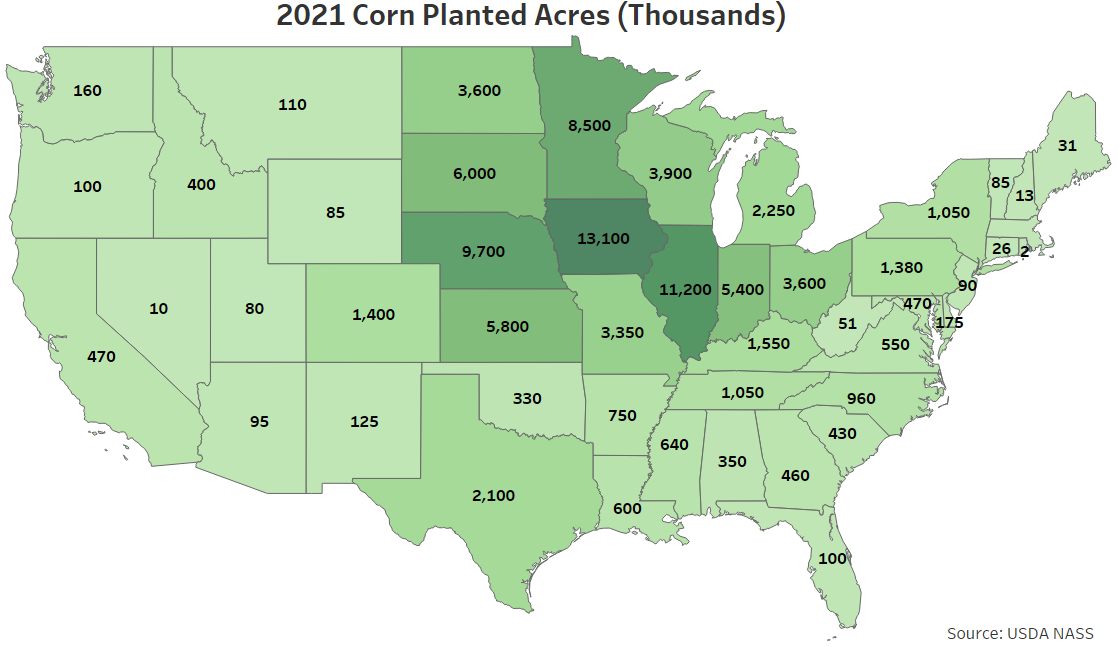

Corn planted acres for 2021 were led by Iowa (13.1 million acres), followed by Illinois (11.2 million acres) and Nebraska (9.7 million acres). The aforementioned states combined to account for over a third of the total U.S. corn plantings.

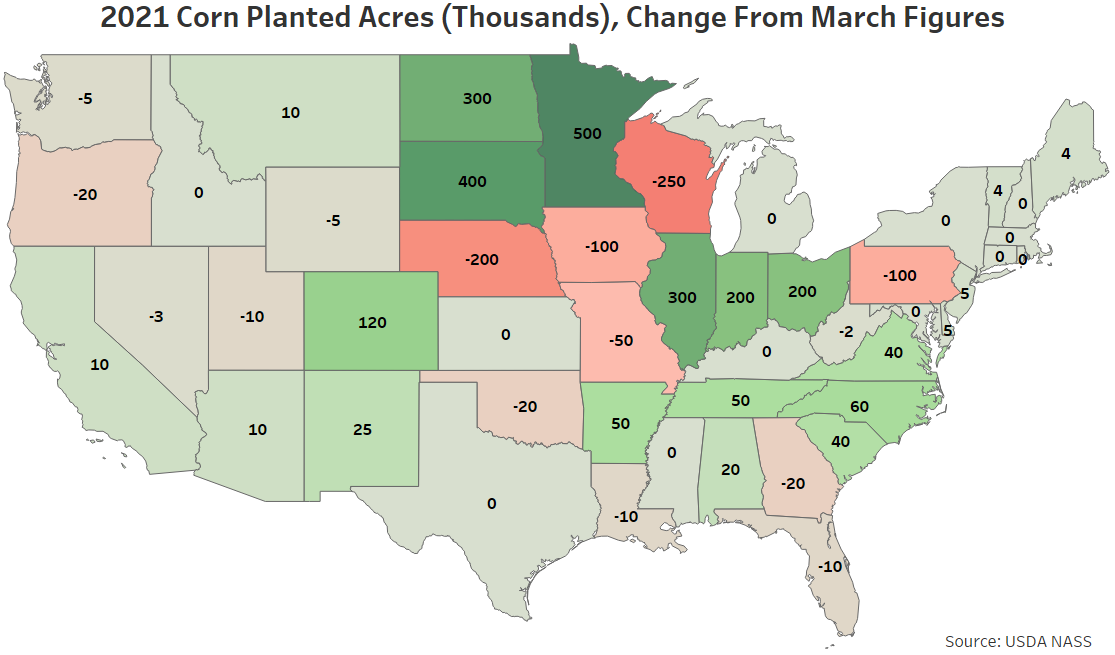

Corn planted acres for 2021 were revised most significantly higher within Minnesota (+500,000 acres) and South Dakota (+400,000 acres). Wisconsin (-250,000 acres) and Nebraska (-200,000 acres) experienced the largest declines in corn planted acres from the March report.

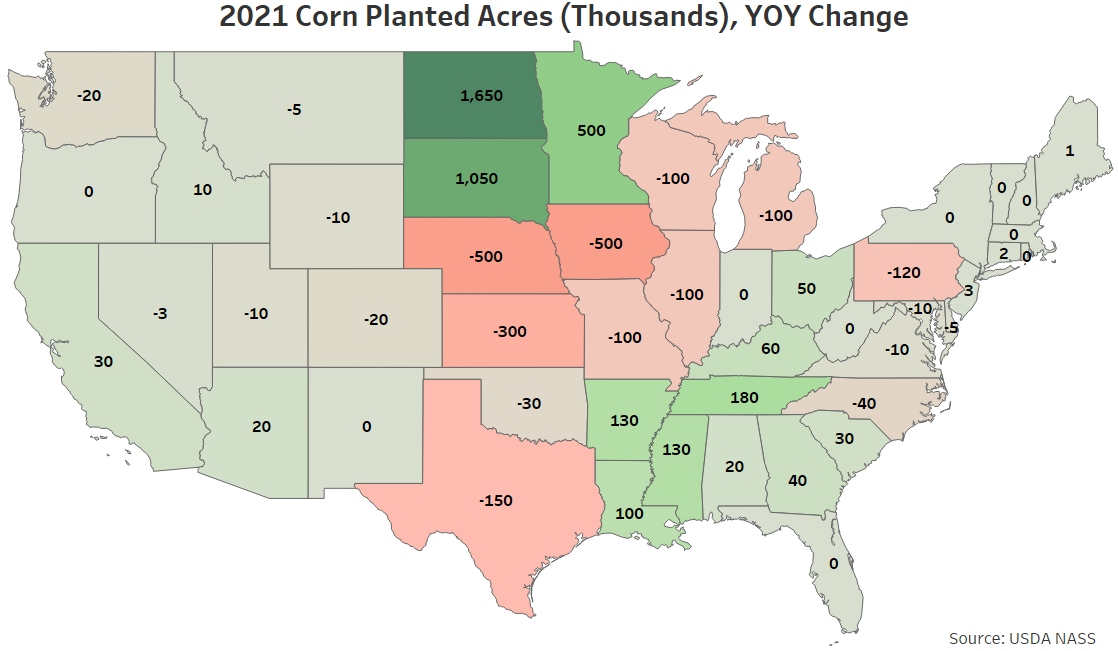

Corn acres finished most significantly higher on a YOY basis throughout North Dakota (+1,650,000 acres), followed by South Dakota (+1,050,000 acres) and Minnesota (+500,000 acres). Iowa (-500,000 acres) and Nebraska (-500,000 acres) experienced the largest YOY declines in corn plantings.

Soybeans – Planted Acres Increase to a Three Year High Level but Finish Below Expectations

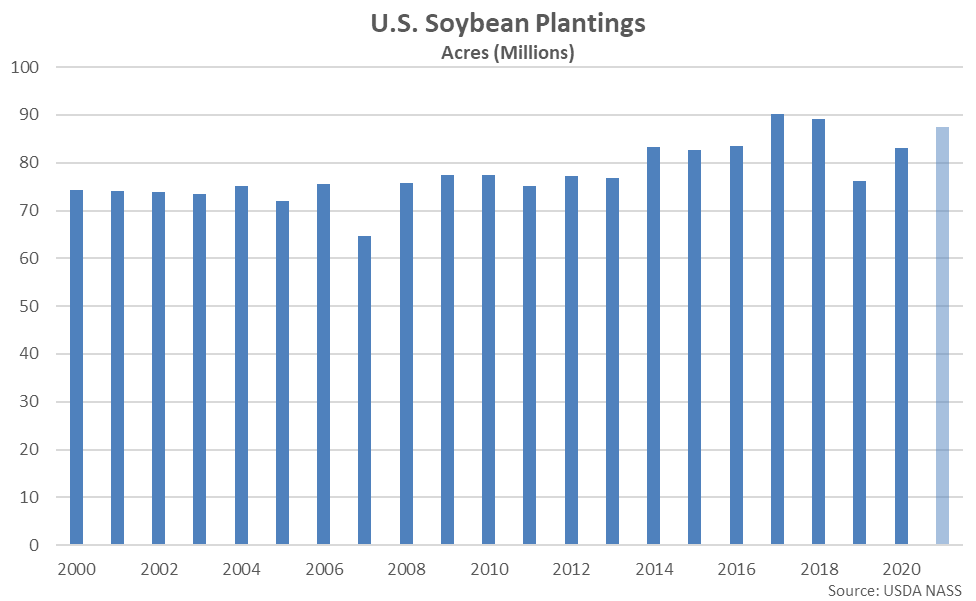

Soybean planted acres for 2021 of 87.6 million acres finished 45,000 acres, or 0.1%, below the March estimated figure but 4.5 million acres, or 5.4%, above the previous year figure, reaching a three year high level. Soybean plantings finished 1.5 million acres, or 1.7%, below analyst expectations of 89.1 million acres, however.

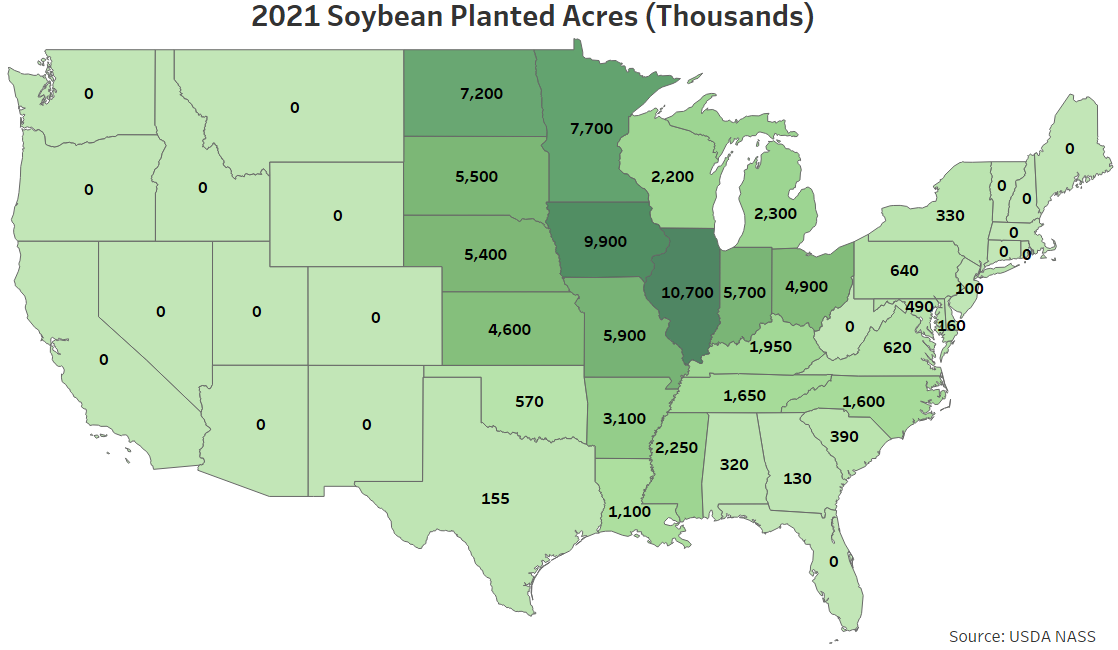

Soybean planted acres for 2021 were led by Illinois (10.7 million acres), followed by Iowa (9.9 million acres) and Minnesota (7.7 million acres). The aforementioned states combined to account for nearly a third of all U.S. soybean plantings.

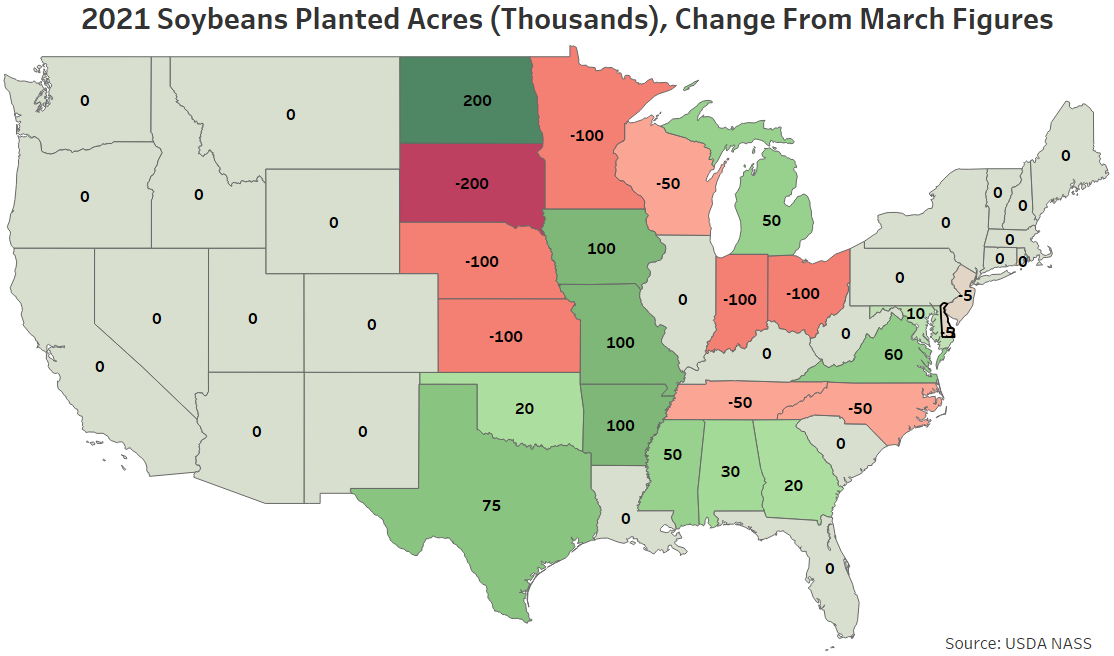

Soybean planted acres for 2021 were revised most significantly lower within South Dakota (-200,000 acres). North Dakota (+200,000 acres) experienced the largest increase in soybean planted acres from the March report.

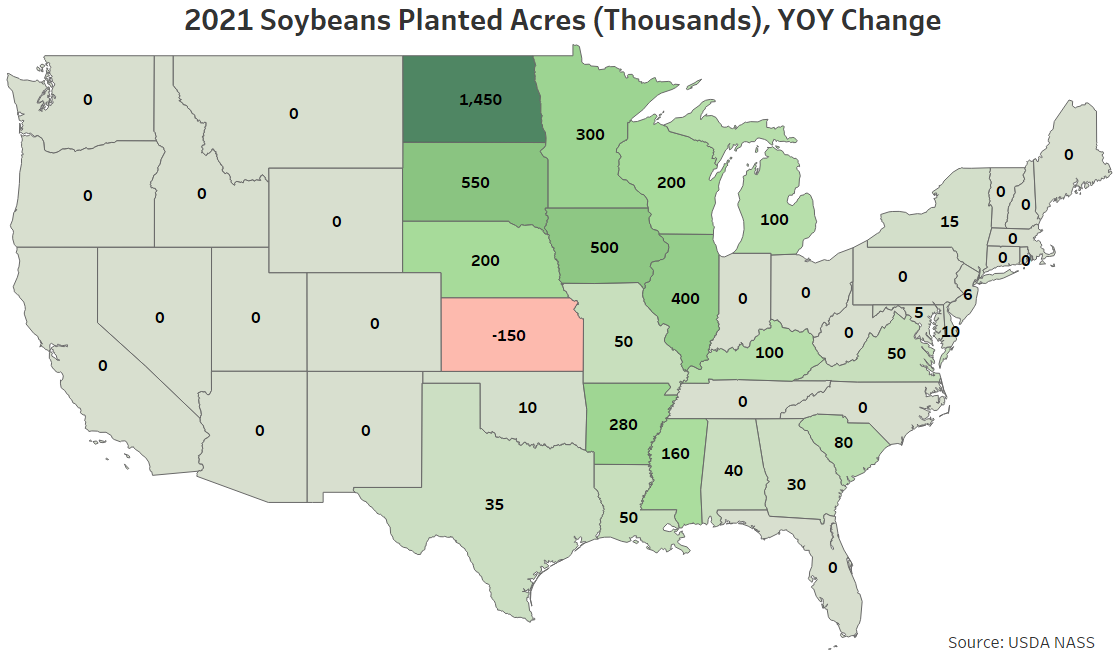

Soybean acres finished most significantly higher on a YOY basis throughout North Dakota (+1,450,000 acres), followed by South Dakota (+550,000 acres) and Iowa (+500,000 acres). Kansas (-150,000 acres) experienced the largest YOY decline in soybean plantings.

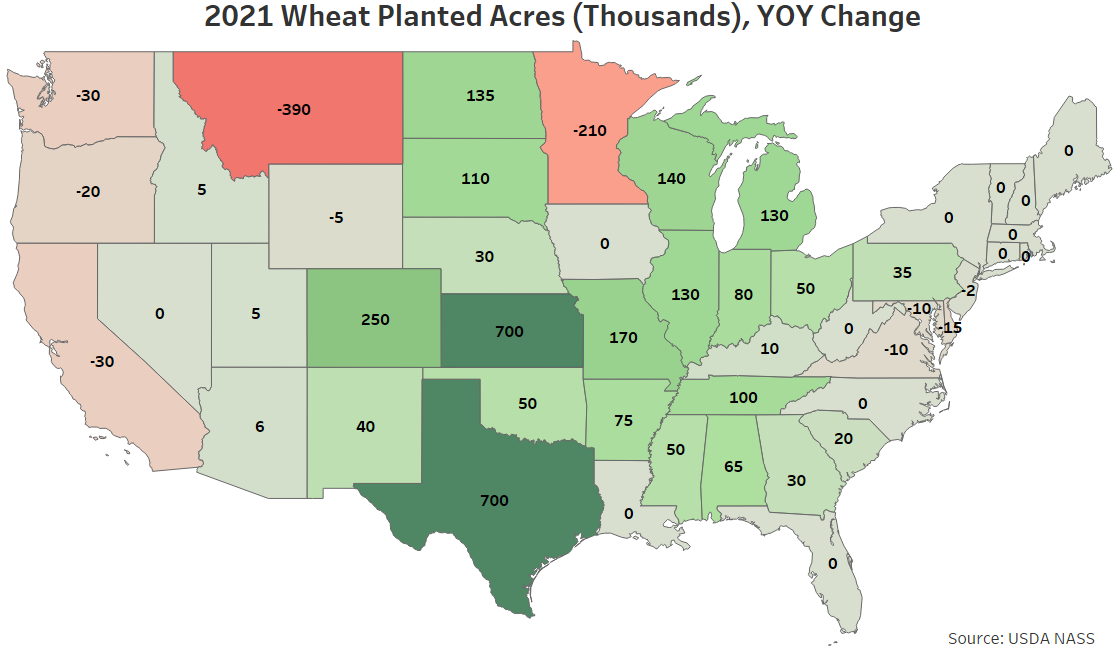

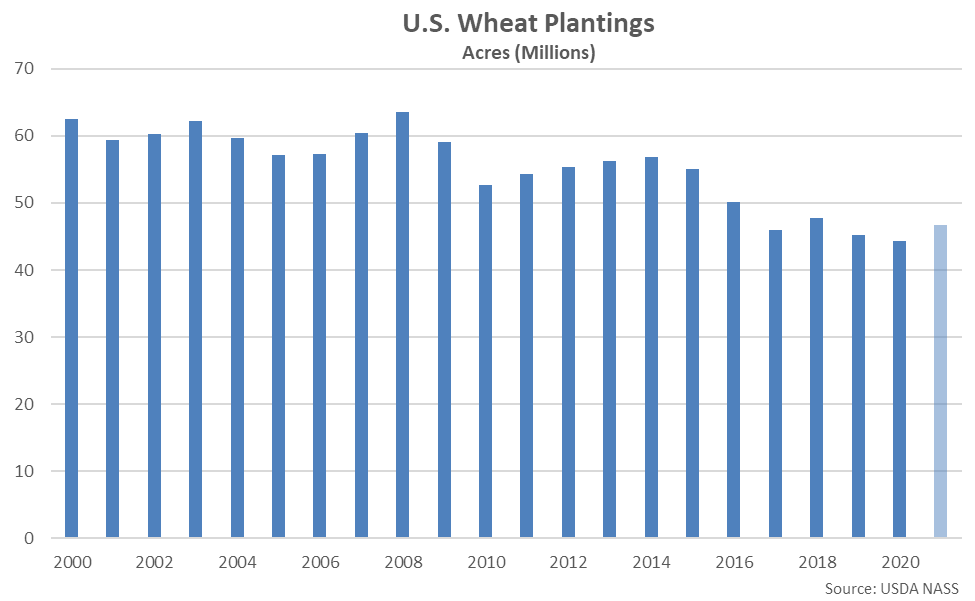

Wheat – Planted Acres Increase to a Three Year High Level, Finish Above Expectations

Wheat planted acres for 2021 of 46.7 million acres finished 385,000 acres, or 0.8%, above the March estimated figure and 2.4 million acres, or 5.4%, above the previous year’s record low level, reaching a three year high level. Wheat plantings finished 743,000 acres, or 1.6%, above analyst expectations of 46.0 million acres.

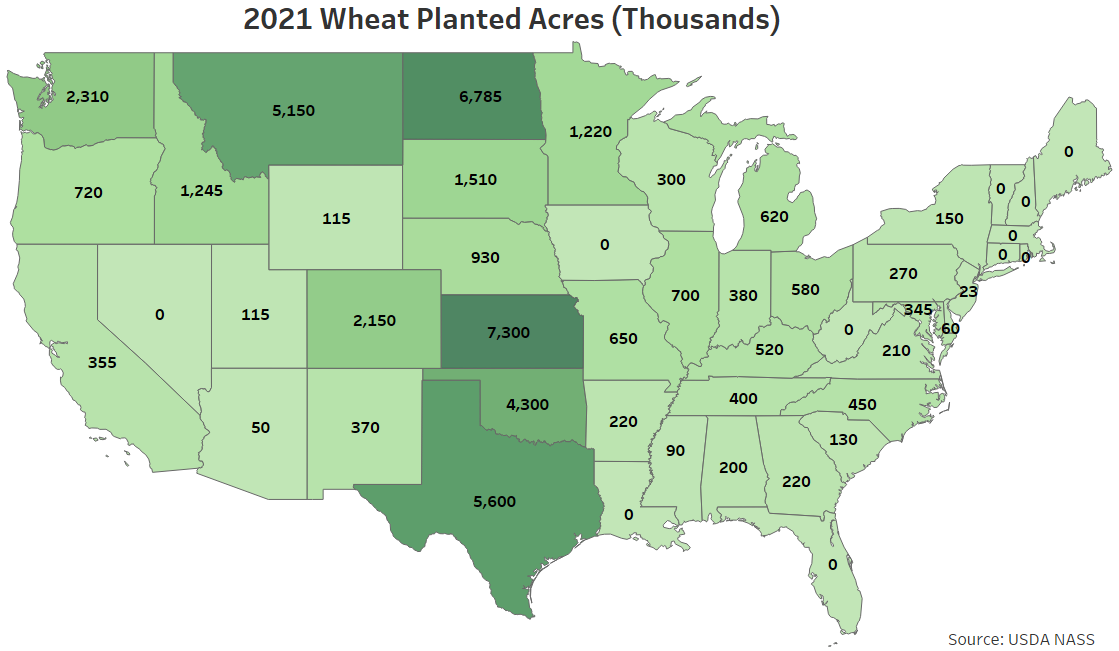

Wheat planted acres for 2021 were led by Kansas (7.3 million acres), followed by North Dakota (6.785 million acres) and Texas (5.6 million acres). The aforementioned states combined to account for over 40% of the total U.S. wheat plantings.

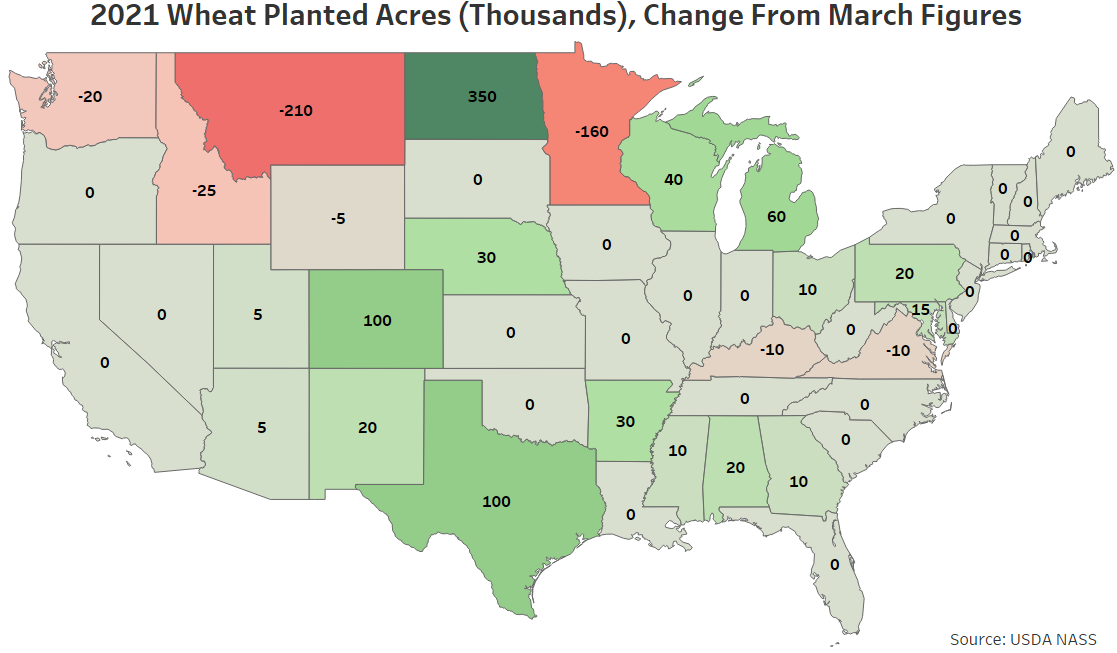

Wheat planted acres for 2021 were revised most significantly higher within North Dakota (+350,000 acres), followed by Texas (+100,000 acres) and Colorado (+100,000 acres). Montana (-210,000 acres) and Minnesota (-160,000 acres) experienced the largest declines in wheat planted acres from the March report.

Wheat acres finished most significantly higher on a YOY basis throughout Kansas (+700,000 acres) and Texas (+700,000 acres). Montana (-390,000 acres) experienced the largest YOY decline in wheat plantings.