U.S. Cattle on Feed Update – Nov ’19

Executive Summary

U.S. cattle on feed figures provided by USDA were recently updated with values spanning through the end of Oct ’19. Highlights from the updated report include:

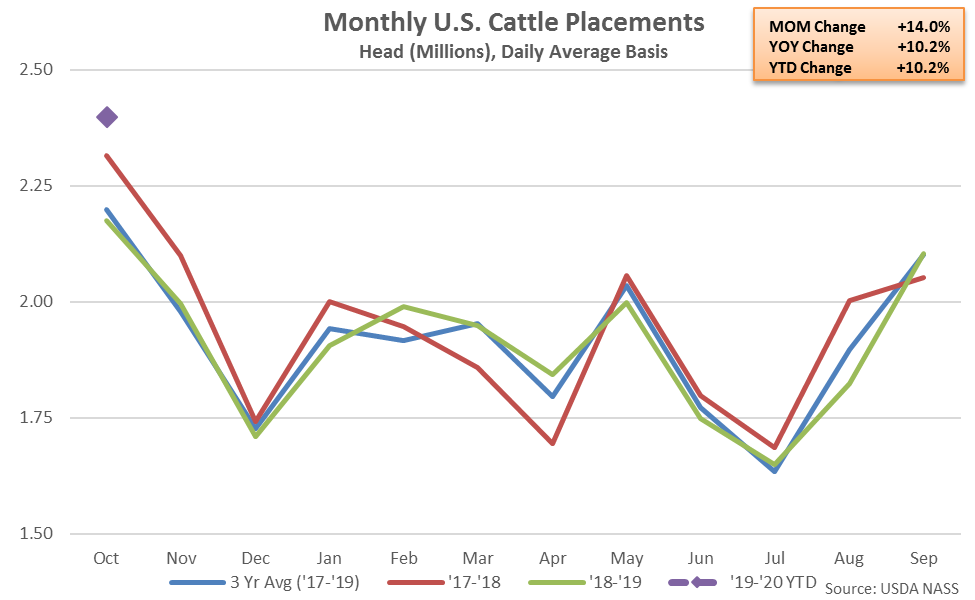

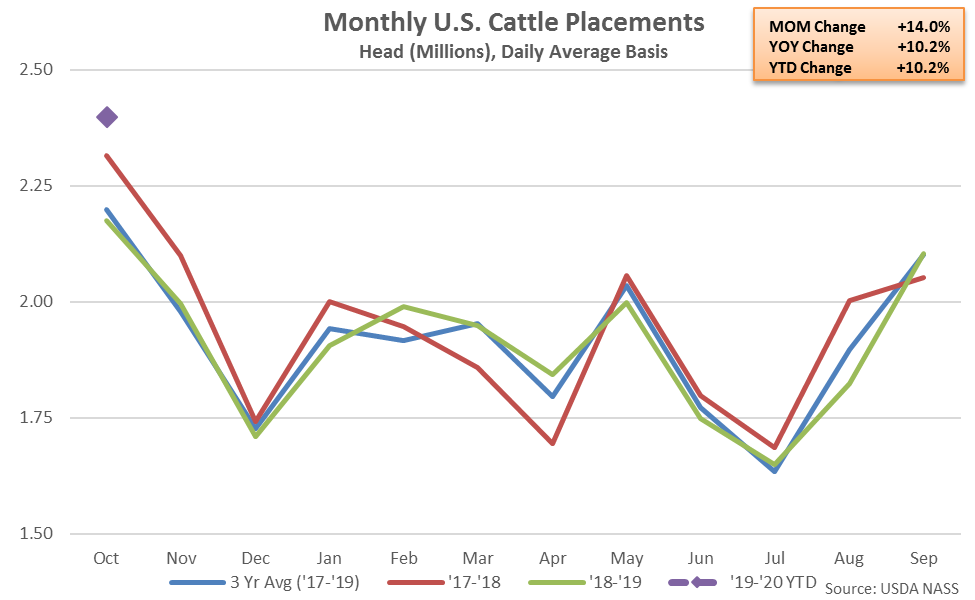

Placements in feedlots during Oct ‘19 increased 10.2% from October of last year, finishing higher on a YOY basis for the second consecutive month and reaching a nine year high seasonal level. The 10.2% YOY increase in placements was below average analyst expectations of a 12.2% increase, however.

Placements for those weighing 800 pounds or more increased the most on a YOY basis throughout Oct ’19, finishing up 29.5%, followed by placements weighing 700-799 pounds (+14.9%) and placements weighing 600-699 pounds (+2.9%). Placements weighing less than 600 pounds declined 6.2% on a YOY basis throughout the month. Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.7% above three year average figures.

Placements in feedlots during Oct ‘19 increased 10.2% from October of last year, finishing higher on a YOY basis for the second consecutive month and reaching a nine year high seasonal level. The 10.2% YOY increase in placements was below average analyst expectations of a 12.2% increase, however.

Placements for those weighing 800 pounds or more increased the most on a YOY basis throughout Oct ’19, finishing up 29.5%, followed by placements weighing 700-799 pounds (+14.9%) and placements weighing 600-699 pounds (+2.9%). Placements weighing less than 600 pounds declined 6.2% on a YOY basis throughout the month. Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.7% above three year average figures.

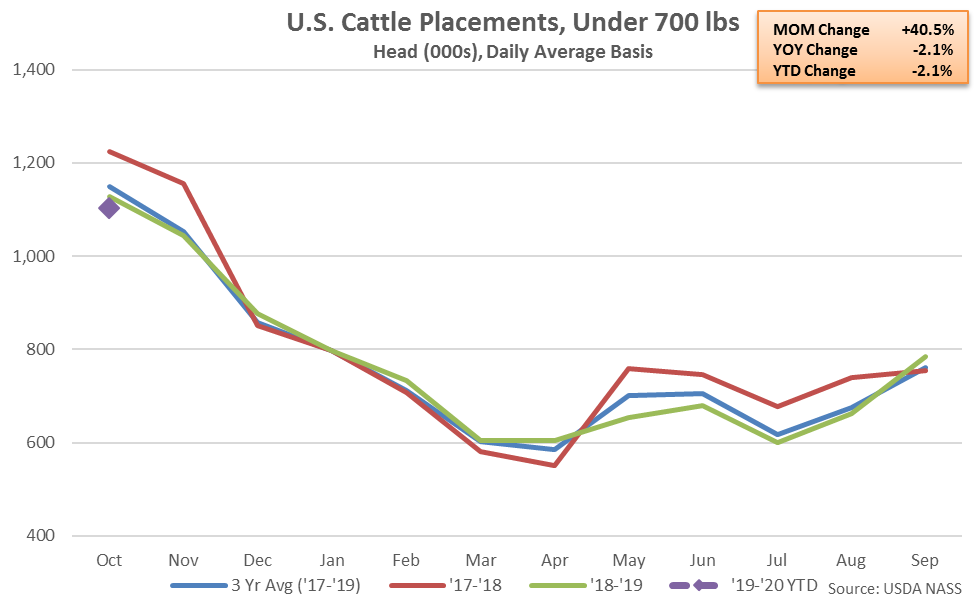

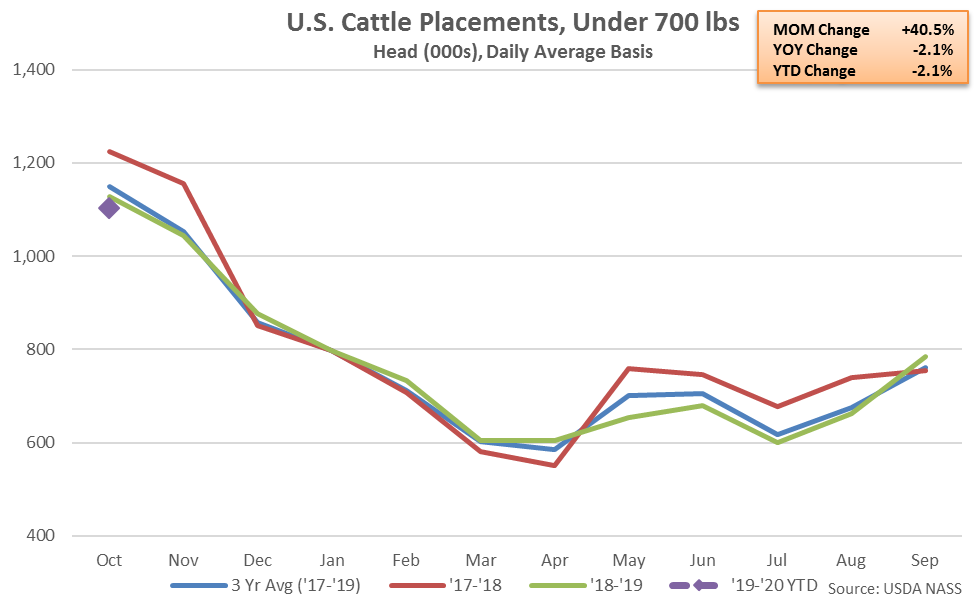

Oct ’19 cattle placements weighing under 700 pounds declined 2.1% on a YOY basis, finishing lower for the fifth time in the past six months. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season.

Oct ’19 cattle placements weighing under 700 pounds declined 2.1% on a YOY basis, finishing lower for the fifth time in the past six months. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season.

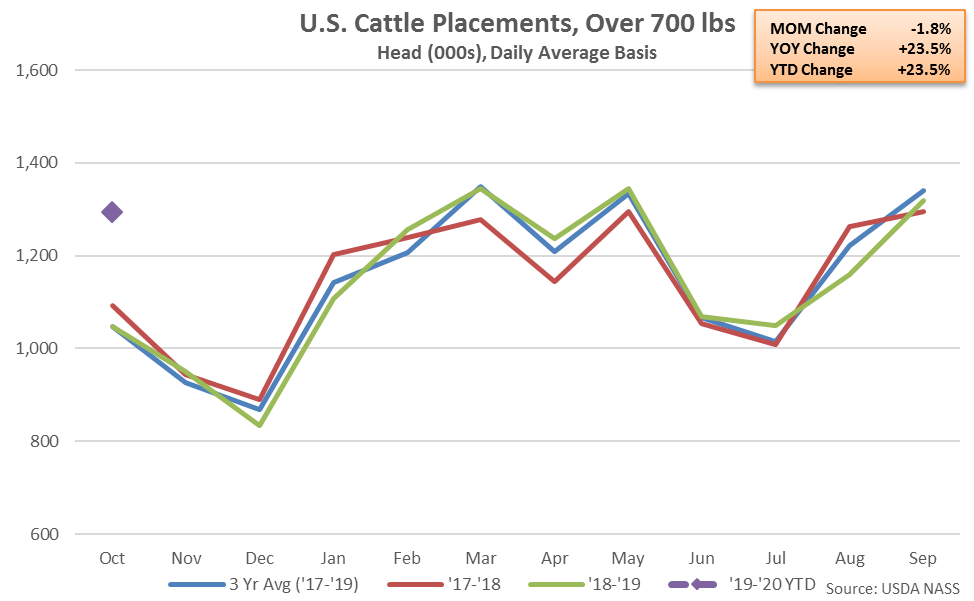

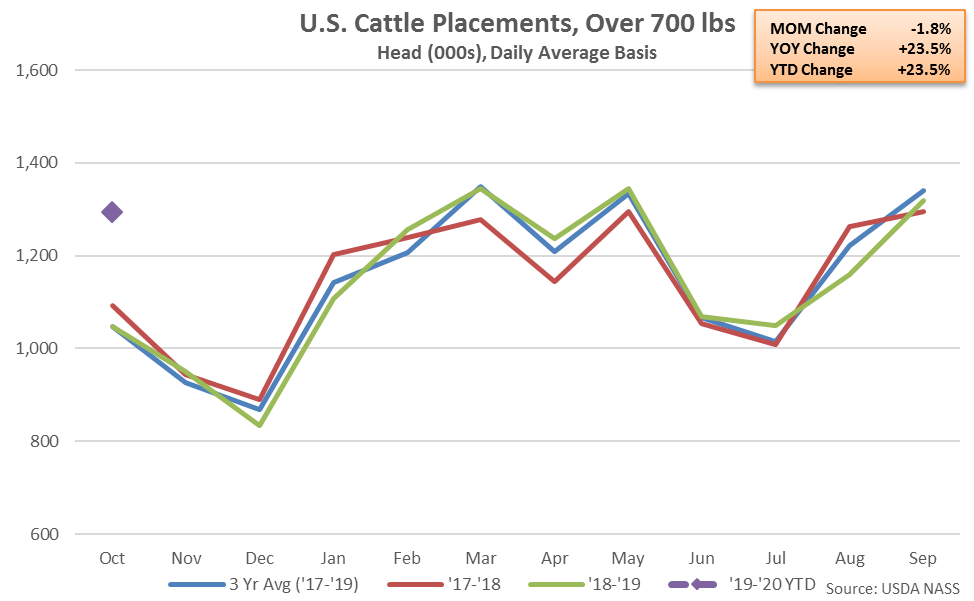

Oct ’19 cattle placements weighing 700 pounds or more increased 23.5% on a YOY basis, finishing higher for the eighth time in the past nine months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season.

Oct ’19 cattle placements weighing 700 pounds or more increased 23.5% on a YOY basis, finishing higher for the eighth time in the past nine months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season.

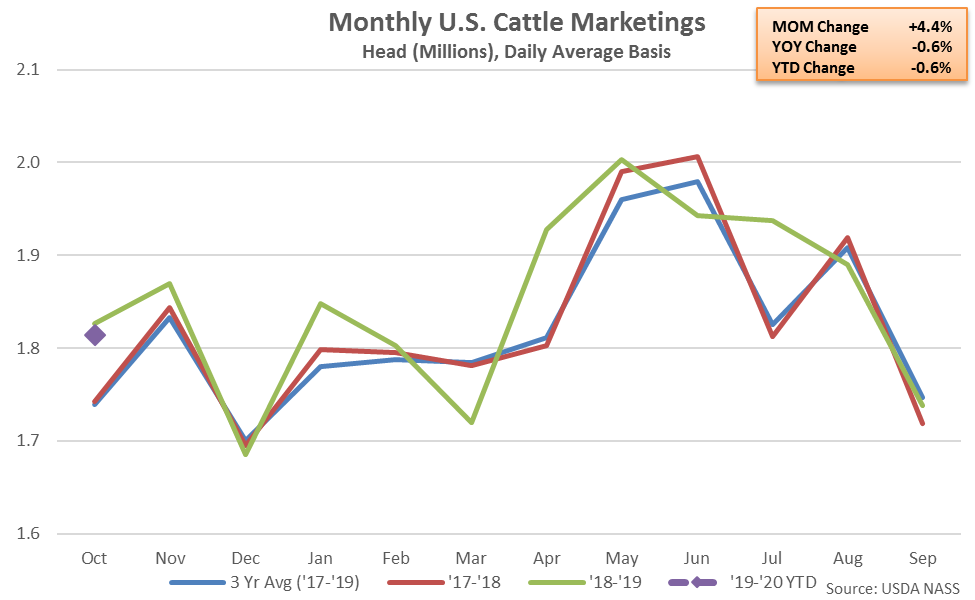

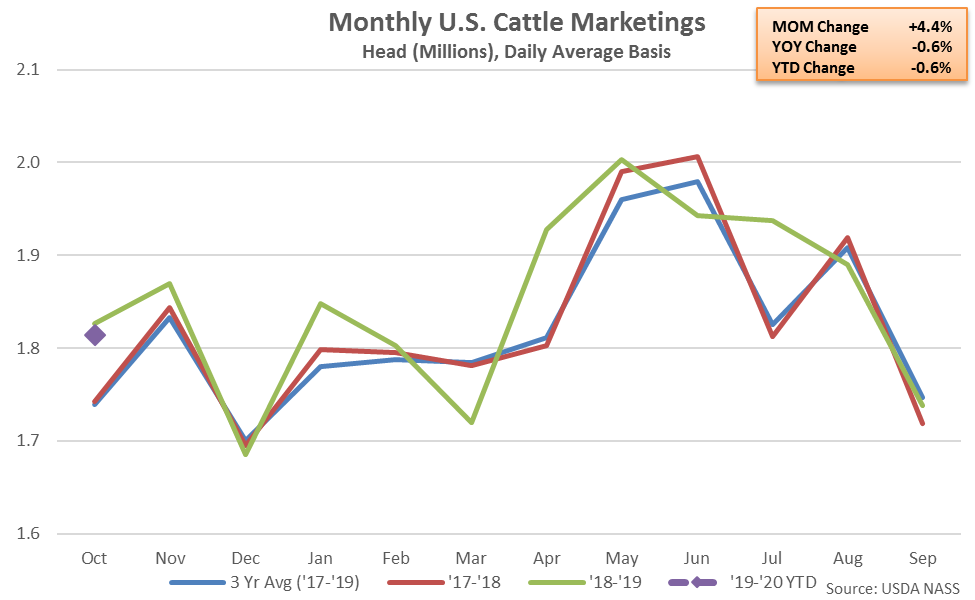

Marketings of fed cattle during Oct ’19 finished 0.6% below October of last year, declining on a YOY basis for the second time in the past three months. The 0.6% YOY decline in marketings was slightly greater than average analyst expectations of a 0.4% decline. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high.

Marketings of fed cattle during Oct ’19 finished 0.6% below October of last year, declining on a YOY basis for the second time in the past three months. The 0.6% YOY decline in marketings was slightly greater than average analyst expectations of a 0.4% decline. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high.

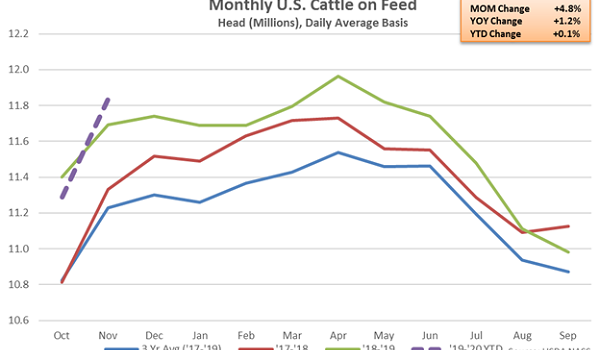

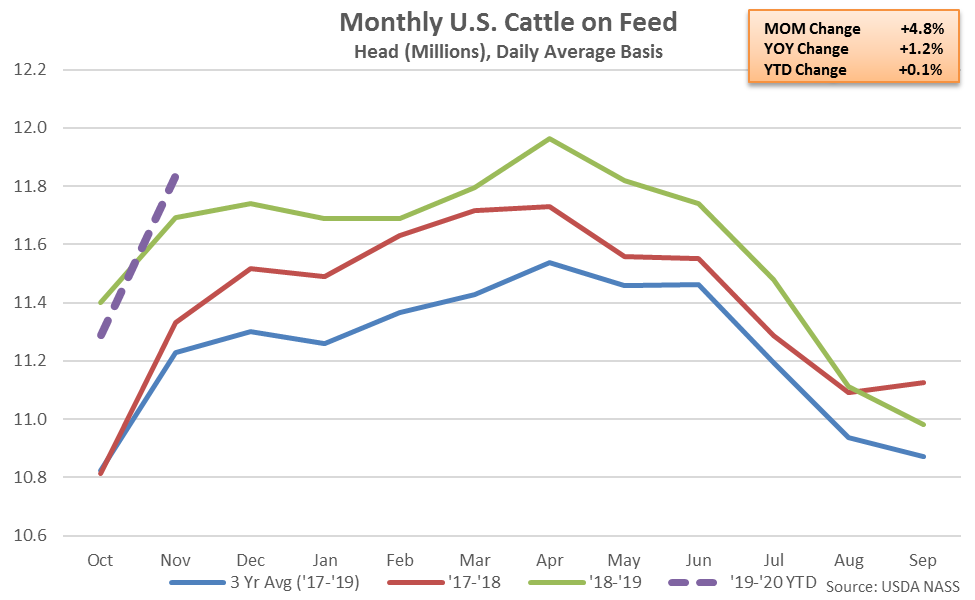

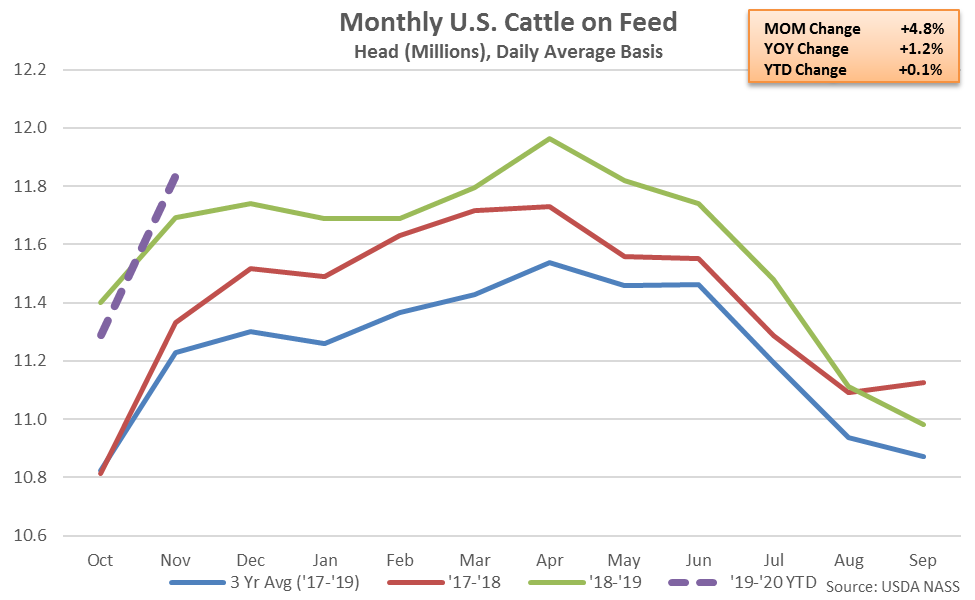

- U.S. cattle and calves on feed for the slaughter market as of Nov 1st increased on a YOY basis for the first time in the past three months, finishing up 1.2% and reaching an eight year high seasonal level. The YOY increase in the cattle on feed supply was slightly below average analyst expectations of a 1.4% increase, however.

- Oct ’19 placements in feedlots increased 10.2% YOY, finishing higher on a YOY basis for the second consecutive month and reaching a nine year high seasonal level. The YOY increase in placements was below average analyst expectations of a 12.2% increase, however.

- Oct ’19 marketings of fed cattle declined 0.6% on a YOY basis, finishing lower on a YOY basis for the second time in the past three months. The YOY decline in marketings was slightly greater than average analyst expectations of a 0.4% decline.

Placements in feedlots during Oct ‘19 increased 10.2% from October of last year, finishing higher on a YOY basis for the second consecutive month and reaching a nine year high seasonal level. The 10.2% YOY increase in placements was below average analyst expectations of a 12.2% increase, however.

Placements for those weighing 800 pounds or more increased the most on a YOY basis throughout Oct ’19, finishing up 29.5%, followed by placements weighing 700-799 pounds (+14.9%) and placements weighing 600-699 pounds (+2.9%). Placements weighing less than 600 pounds declined 6.2% on a YOY basis throughout the month. Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.7% above three year average figures.

Placements in feedlots during Oct ‘19 increased 10.2% from October of last year, finishing higher on a YOY basis for the second consecutive month and reaching a nine year high seasonal level. The 10.2% YOY increase in placements was below average analyst expectations of a 12.2% increase, however.

Placements for those weighing 800 pounds or more increased the most on a YOY basis throughout Oct ’19, finishing up 29.5%, followed by placements weighing 700-799 pounds (+14.9%) and placements weighing 600-699 pounds (+2.9%). Placements weighing less than 600 pounds declined 6.2% on a YOY basis throughout the month. Total placements in feedlots declined 1.6% on a YOY basis throughout the ’18-’19 production season, however annual placement rates remained 2.7% above three year average figures.

Oct ’19 cattle placements weighing under 700 pounds declined 2.1% on a YOY basis, finishing lower for the fifth time in the past six months. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season.

Oct ’19 cattle placements weighing under 700 pounds declined 2.1% on a YOY basis, finishing lower for the fifth time in the past six months. Cattle placements weighing under 700 pounds finished 3.9% lower on a YOY basis throughout the ’18-’19 production season.

Oct ’19 cattle placements weighing 700 pounds or more increased 23.5% on a YOY basis, finishing higher for the eighth time in the past nine months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season.

Oct ’19 cattle placements weighing 700 pounds or more increased 23.5% on a YOY basis, finishing higher for the eighth time in the past nine months. Cattle placements weighing 700 pounds or more increased 0.1% on a YOY basis throughout the ’18-’19 production season.

Marketings of fed cattle during Oct ’19 finished 0.6% below October of last year, declining on a YOY basis for the second time in the past three months. The 0.6% YOY decline in marketings was slightly greater than average analyst expectations of a 0.4% decline. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high.

Marketings of fed cattle during Oct ’19 finished 0.6% below October of last year, declining on a YOY basis for the second time in the past three months. The 0.6% YOY decline in marketings was slightly greater than average analyst expectations of a 0.4% decline. ’18-’19 annual marketings of fed cattle increased 1.3% YOY, reaching an 11 year high.